There are many different ways to trade cryptocurrency. You may have heard of “shorting” Bitcoin, crypto margin trading, or crypto trading with leverage. All of these terms refer to the same practice — leverage trading — but the interchangeable way they are used can make understanding how it works a little difficult.

Crypto margin trading doesn’t have to be complicated, however. In simple terms, the crypto market is volatile. The price fluctuations exhibited by crypto markets make it possible for crypto traders to turn a profit in both bear and bull markets through Bitcoin margin trading.

What is it, though, and how does it work?

What is Crypto Margin Trading?

Attempting to decipher the complicated world of crypto margin trading can quickly overwhelm a newer trader. If you’ve ever run a quick search on how Bitcoin margin trading works you’ve likely been presented with a massive glossary of terms such as leverage, liquidation price, margin calls, shorting, and more.

The basics of Bitcoin margin trading are relatively straightforward, though, so we’ll cut through the noise: Put simply, a cryptocurrency or Bitcoin margin trade allows traders to “borrow” capital in order to access increased buying power and open positions far larger than their “real” account balance.

Crypto margin trading is a trading practice that allows traders to gain greater exposure to a specific asset by borrowing capital from other traders on an exchange or the exchange itself. In contrast with regular trading in which traders use their own capital to fund trades, margin trading allows traders to multiply the amount of capital they are able to trade.

Margin trading is also often referred to as leverage trading — “leverage” is the amount by which a trader is able to multiply their position. A margin trader that opens a trade with 100X leverage, for example, will multiply their exposure and potential profit by 100 times.

Margin trading sounds great at first glance — the ability to multiply profits by 100X would capture the attention of any trader. There’s a downside to margin trading Bitcoin, however. Using leverage in Bitcoin trading to amplify your position gives you a higher risk.

Can you lose it all when margin trading Bitcoin, though? If you’re able to multiply your profits by 100X, does that mean you could end up owing an exchange 100X your losses?

Fortunately, the increase in risk when margin trading crypto is not proportionate to leverage. Trading with 100X leverage, for example, won’t multiply your losses by 100X — it’s most often not possible to lose more than you originally commit to a trade. However, losses can theoretically exceed committed assets in specific scenarios.

Margin trading is popular in markets in slower-moving, low-volatility markets such as the Forex market, but has now become extremely popular in the fast-moving crypto market as well.

How Crypto Margin Trading Works

Leverage trading Bitcoin works quite simply at a fundamental level. A trader gives the exchange a little bit of capital in return for a lot of capital to trade with, and risks it all for the chance to make a huge profit.

In order to margin trade, a trader must provide an initial deposit to open a position, referred to as the “initial margin,” and must hold a specific amount of capital in their account to keep the position, referred to as the “maintenance margin.”

Different crypto exchanges offer differing amounts of leverage. Some exchanges offer 200X leverage, which allows traders to open a position 200 times the value of their initial deposit, while others limit leverage to 20X, 50X or 100X.

The terminology used to define leverage can differ from platform to platform. Some exchanges in the Forex market, for example, will refer to 100X leverage as 100:1 leverage. Leverage is typically referred to via the former “X” terminology in the crypto trading world. 100X leverage is the same as 100:1 leverage.

If you open a margin trade with a crypto exchange the amount of capital you deposit to open the trade is held as collateral by the exchange. The amount you are able to leverage when margin trading depends on the rules imposed by the exchange that you trade on and your initial margin.

Going Short Versus Going Long

When you open a crypto margin trading position, you’ll be given the choice of “going short” or “going long.”

A long position is taken by a trader that thinks the price of a digital asset will rise. Going short, or “shorting,” is the opposite. A trader will open a short position if they believe a digital asset will fall in value. Shorting is used by traders that seek to profit from falling crypto prices.

It’s important to note that the exchange you trade on will hold collateral for the capital you borrow when margin trading. Should you close a position at a profit, the exchange will release the crypto you deposited to open the position, along with any profits.

If you incur a loss when margin trading, however, the exchange will automatically close your trade and “liquidate” your position. This occurs when the price of the relevant asset reaches a specific threshold, which we call the “liquidation price.”

Understanding Margin Calls & Liquidation

When you borrow money from an exchange in order to margin trade Bitcoin, the exchange that provides the capital keeps a number of controls in place in order to lower their risk. If you open a trade and the market moves against you, it may happen that the exchange will ask for more collateral in order to secure your position or forcibly close the position.

When this occurs, your exchange is likely to hit you with a so called margin call. A margin call occurs when the value of the asset in a margin trade falls below a certain point. The exchange that funds the margin trade will ask for more funds from the trader in order to lower their risk. Most exchanges will notify traders via email, but it’s important to actively monitor your margin levels.

If the margin level of a position becomes too insecure, an exchange is likely to close the position — this is referred to as the margin liquidation level, or liquidation price. Liquidation occurs when an exchange automatically closes a position in order to ensure the only capital lost is the capital deposited by the trader that opened the position.

Let’s suppose a trader opens a 2:1 long position when the price of Bitcoin is $10,000. The cost of the position is $10,000, but the trader has borrowed an additional $10,000 from the exchange. The liquidation price of the position is therefore $5,000 — at this price level, the trader has lost their initial $10,000 collateral and is thus liquidated by the exchange.

Why Margin Trade?

Margin trading allows confident traders to open positions that can be far more profitable than they would otherwise be able to access. A successfully closed position at 100X leverage, for example, will yield 100 times more profit than a position opened via a “normal” trade.

Margin trading Bitcoin and other cryptos also allows strategic traders to generate profit in a bear market by opening short positions. A trader that expects a large price dip, for example, could commit a portion of their portfolio to a short position in order to get a profit that offsets the potential loss incurred by a major price dip.

Crypto Margin Trading Exchanges

Choosing the best bitcoin leverage trading platform can be a difficult process — there are many exchanges online today that offer leveraged trading. Trading on the highest leverage crypto trading platform is not always the best option. There are a number of important factors that should be considered when selecting margin trading crypto exchanges.

Different exchanges offer different levels of leverage. Some margin Bitcoin exchanges, such as BaseFEX or PrimeXBT, offer up to 100X leverage. The interest rates offered by on leveraged trading are another essential factor — depending on the length and leverage of your position, you may end up paying extremely high interest rates.

BitMax, for example, is a highly popular exchange that offers leveraged trading of up to 100X with variable interest rates — one of the highest leverage Bitcoin trading platforms online. The interest rates offered by BitMax can be as low as 3.65% per year, or 0.01% per day, which is a highly favorable rate for short-term positions.

Some margin traders use complex order types in order to take profit incrementally or set up stop losses, which lowers the risk of liquidation. Some margin crypto exchanges may offer fewer order type options than others. ByBit, another margin trading crypto exchange that offers up to 100X leverage, makes a wide range of complex order types available to traders seeking to create effective risk management strategies when trading.

It’s also important to consider the funding and fiat support options of an exchange when margin trading. CEX.io is one of the few exchanges that offer both crypto margin trading and fiat deposits, which makes it possible to fund or withdraw from an account via wire transfer or credit card payments.

The KYC and AML requirements may affect which exchanges you can trade at. US Securities law may prevent US-based traders from leverage trading crypto on some platforms, so it’s important to check which platforms are available where you are at. Simex is an example of a popular crypto margin trading exchange that US traders can trade at.

Another very popular exchange offering margin trading is Phemex.

How to Margin Trade Crypto

Understanding how to leverage trade crypto can be somewhat complex to newer traders. We’ll proceed to break down the process of creating a leveraged Bitcoin position. In this example we’ll show you the steps you need to take when you want to open a leveraged Bitcoin position on PrimeXBT.

The steps involved in this process are:

- Registration

- Funding

- Trade screen navigation & outline

- Opening a position

1. Registration

The first step in learning how to how to leverage trade bitcoin is to create an account with an exchange where you can margin trade. One such example is PrimeXBT. You’ll need to navigate to the PrimeXBT exchange website and complete the signup process to create an account.

After confirming your email address etc., you’re ready to fund your account.

2. Funding

Before you can start trading on PrimeXBT, you’ll need to fund your account so you have the capital to open a position. PrimeXBT’s onboarding process will prompt you to make a deposit via Bitcoin:

PrimeXBT provides traders with the option to fund their account via Bitcoin deposit or via credit card purchase. Funding your account via credit card goes very fast, but also means that you have to pay a higher fee than if you are funding your account via Bitcoin.

Once you’ve funded your account you’ll need to navigate to the “account summary” tab on the sidebar of your PrimeXBT account and fund your trading account — this is an instant internal transfer that moves Bitcoin from your wallet to your active trading account.

3. Trading Screen Navigation & Outline

After funding your trading account, it’s time to navigate to the trade window by clicking “Trade” on the top navigation bar. You’ll be presented with the trade window. Select the BTC/USD pair at the top of the currency pair list and click “Trade”.

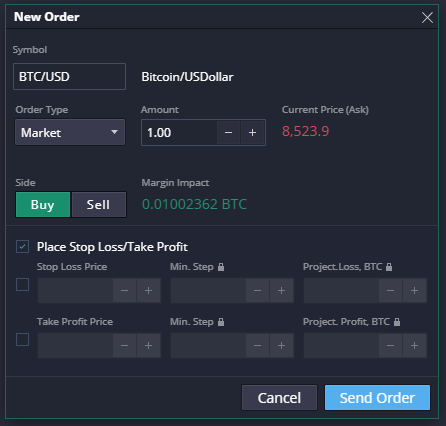

You will now see the order window through which you will create your position.

4. Entering Position Details

The order window will allow you to define the details of your order. You’ll need to select from market, limit, stop, or OCO order type and enter the details of the position you would like to take. It’s important to note that PrimeXBT uses 100X leverage.

In this example we’ll open a 1 BTC position, which will require 0.01002362 BTC to open. You should always enter a stop loss price at this stage in order to lower the risk of liquidation. If you’re aiming to take a long position, you’ll need to create a “buy” order. If you want to take a short position, you’ll need to create a “sell” order.

Once you’ve fixed your order, click the blue “send order” button. PrimeXBT will present a live overview of your order at the bottom of the trading window. An account overview at the top of the trade window will outline the current balance, equity, unrealized PL, used margin, and available margin of your PrimeXBT account.

Crypto Margin Trading Strategies

Margin trading is regarded as a high-risk investment strategy that depends on the short-term market movement. The crypto market is very volatile when compared to traditional securities or forex markets, which makes it more risky.

There are a number of important practices and strategies that you should think about before margin trading Bitcoin or other cryptos:

- Progressively increase trade size: If you’re new to margin trading, it’s best to develop a firm understanding of the practice by starting with smaller position sizes and lower leverage.

- Try your hand at demo trading: Paper trading, also known as demo trading, allows new traders to “practice” trade in a fake trading environment. Demo trading platforms don’t take real money, but they do reflect real market prices. Demo trading gives newer traders the ability to put their strategies into action without risking capital.

- Understand order types: Margin traders often use combinations of order types such as stop loss and take profit in order to lower risk and open complex positions. These order types can assist by setting specific profit or loss targets and automatically closing positions.

- Divide your position: You can lower your risk by spreading a position into separate portions. Creating a ladder of take-profit levels allows traders to capture profits incrementally.

- Pay attention to fees and interest: When you open a leveraged position you will pay interest on the capital you borrow. Margin trading Bitcoin and other cryptos incurs ongoing fees that can quickly cut into your profits.

- Set clearly-defined goals and lower your risk: You should follow a concrete risk management strategy when margin trading. This strategy should establish a clear profit goal — and you should stick to this goal. Stop-loss levels and adhering to an exit goal is very important.

- Pay attention to both fundamental and technical factors: Crypto market movements are largely driven by technical factors — at least in part due to the high number of traders active within the crypto ecosystem that trade based on technical analysis. Fundamental factors can have a profound and sudden impact on crypto prices, however. Regulatory changes, major Bitcoin wallet movements, and major exchange hacks can catalyze large unexpected price shifts.

What are the Risks of Crypto Margin Trading?

Margin trading is a high-risk, high reward practice. There are a number of risks unique to the cryptocurrency market that should be factored into any leveraged crypto trading risk strategy.

The cryptocurrency market is largely unregulated when contrasted with traditional markets. It’s not uncommon to observe both short and long squeezes or price manipulation in the Bitcoin margin trading ecosystem, for example.

Market movers — traders that possess sufficient capital to influence market action — can easily create opposing price moves when the number of long or short positions in the market increases significantly. Market movers are able to create market conditions that force the liquidation of these positions.

The inherently volatile nature of the cryptocurrency market makes long-term trades far riskier than traditional markets. Virtually all crypto margin trades consist of short-term leveraged positions. Unlike traditional markets, the cryptocurrency market exhibits extreme short-term fluctuations that must be closely observed at all times while margin trading Bitcoin or other digital assets.

Higher leverage carries higher risk. A trader that opens a high leverage crypto trading position operates with a far narrower liquidation window. It’s essential to calculate the amount of price movement that would result in the liquidation of a position before opening it.

Fortunately, you don’t need to be a nuclear physicist or hold a doctorate in mathematical science to calculate your liquidation risk. There are a number of crypto leverage calculator tools that can be used to assess the risk of liquidation, but it’s relatively simple to perform a quick calculation to assess the liquidation price of a position.

Liquidation price movement can be calculated by dividing 100 by the amount of leverage in a position — a 50X margin trade within the Bitcoin market, for example, would be liquidated immediately if the price of Bitcoin dropped by just 2 percent. A 100X leveraged position, for example, is extremely susceptible to price squeezes, as market movers need only shift asset prices a small amount in order to liquidate high leverage positions.

Summary

Crypto margin trading offers a number of compelling advantages. Margin trading Bitcoin minimizes the threat presented by exchange hacks, as leveraged trading reduces the amount of capital that must be held by an exchange.

If you’re confident in your understanding of the cryptocurrency market and consistently make accurate predictions regarding price movements, margin trading Bitcoin or other digital assets can dramatically increase your profits. Opening the wrong position at the wrong time, however, can seriously damage your financial health.

If you now understand how to margin trade Bitcoin after reading this article and choose to margin trade it’s important that you choose the right margin trading crypto exchange and carefully assess your potential profits and losses before committing to a position.

***

This article was written by Samuel Town (from the company Samuel Town Pty Ltd). Samuel is a freelance journalist, digital nomad, and crypto enthusiast based out of Bangkok, Thailand. As an avid observer of the rapidly evolving blockchain ecosystem he specializes in the FinTech sector, and when not writing explores the technological landscape of Southeast Asia.