Crypto.com Visa Card

Fees & Limits

Funding Methods

Cryptos (129)

Crypto.com Visa Card Review

A common argument for regular money (also known as fiat currency) as opposed to cryptocurrency is that you can’t use cryptocurrency to buy groceries and other everyday items. Well, through the use of a cryptocurrency debit card, you can. This is a review of Crypto.com Visa Card, one of the crypto debit cards out there.

General information

Crypto.com Visa Card is the result of the rebranding of the Monaco Card. The rebranding transition was completed in September 2018 and the card is now shipping in, among other places, Singapore, USA and the countries in the European Union.

Crypto.com Visa Card currently supports the following cryptos: BTC, ETH, LTC, XRP, PAX, TUSD, EOS and XLM (EOS and XLM available in selected states in the US), but it will most likely support even more cryptos in the future.

With respect to fiat currencies, the card supports GBP, USD, HKD, EUR, JPY, SGD and AUD.

The Crypto.com Visa Card is, as you might have expected, a Visa card, meaning that it is accepted essentially everywhere in the world.

Partnership with Booking.com

The Crypto.com VISA Card made headline across the globe on 29 January 2021, when it was announced that they started a partnership with online travel agency Booking.com. Without going into exact detail of the cooperation, we can mention here that the partnership made it possible for Booking.com to accept cryptocurrency payments as payment. This is another step forward for the society's mass adoption of cryptocurrency. Furthermore, the partnership between Crypto.com VISA Card and Booking.com made it possible for Crypto.com VISA Card-holders to book hotel stays through Booking.com at up to 25% discount.

Crypto.com Visa Card Fees

We think that the Crypto.com Visa Card charges insanely competitive fees.

There is no issuance fee. There is no monthly fee (0.00 USD). Actually, there is not even any commission on spending. This means that if you buy a nice sweater for USD 100, this will reduce your crypto assets with only USD 100.

There is no maximum or minimum deposit either. Wow, just wow.

The only fee we have been able to find (comparable to other cards) is the ATM withdrawal fee. There is no such fee for withdrawals up to USD 200 (for the Midnight Blue Card tier, higher tiers have even higher fee free . But thereafter, the fee is 2.00%.

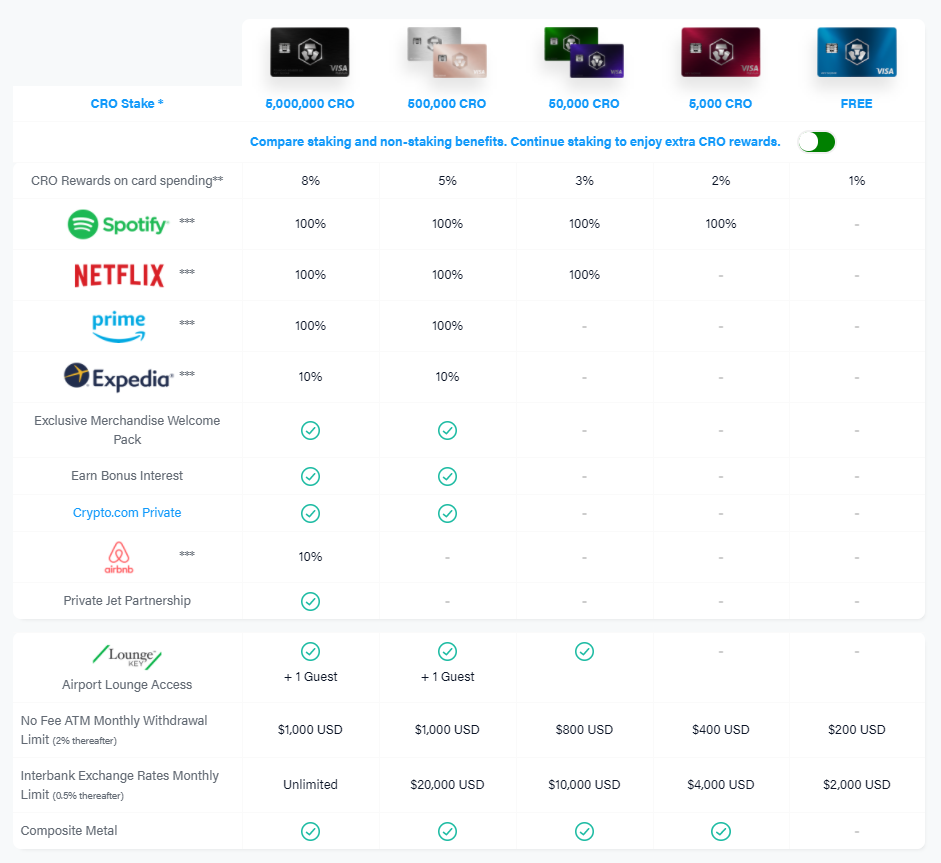

There are six card types (starting from the least exclusive), where the deal you get is the best for the most exclusive. With “deal” we mean higher limit for free ATM-withdrawals and bigger crypto cash-backs (2.00% for the Obsidian Black, see below). See more on this under Different Card Benefits below. These are the card types:

Midnight Blue (no purchase/stake of CRO Tokens required);

Ruby Steel (purchase/stake of at least 5,000 CRO Tokens – to be held for no less than 6 months – required); 100% rebate on Spotify.

Jade Green/Royal Indigo (purchase of at least 50,000 CRO Tokens – to be held for no less than 6 months – required); 100% rebate on Spotify and Netflix, Airport Lounge Access.

Icy White/Frosted Rose Gold (purchase of at least 500,000 CRO Tokens – to be held for no less than 6 months – required); 100% rebate on Spotify, Netflix and Amazon Prime plus 10% rebate of spend on Expedia, Airport Lounge Access.

Obsidian Black (purchase of at least 5,000,000 CRO Tokens – to be held for no less than 6 months – required). Every perks from above tier plus some exclusive luxury perks, such as private jet service.

On the date of last updating this review (20 January 2021), 1 CRO-token was worth around USD 0.083. This means that the four levels mentioned above correspond to the following USD-amounts:

(i) USD 415;

(ii) USD 4,415;

(iii) USD 41,500; and, finally,

(iv) USD 415,000.

Different Card Benefits

The different card levels bring different benefits. The company behind the Crypto.com Visa Card has produced a very helpful overview, showing the benefits from each and every one of the card types. It is available here:

Crypto.com Visa Card Cashback Function

The card from Crypto.com also offers something very interesting: a cashback feature. What is a cashback feature? Well, it's actually quite simple, every time you use the card, a percentage of what you pay with the card gets transferred back to you in the form of CRO-tokens. And the percentage is actually from 1-8%, depending upon how many CRO-tokens that you stake. Please be advised here that it is not necessary that you hold a certain amount of CRO-tokens, you need to stake them as well. The CRO-staking levels required for the different cashback-percentages are set out in the below table:

Concluding remarks

If this is the cryptocurrency debit card for you, congratulations.

If not, check out one of the other epic cryptocurrency debit cards in our cryptocurrency debit card list. Good luck!