Kraken

Exchange Fees

Deposit Methods

Cryptos (129)

Kraken Review

What is Kraken?

Kraken is an American crypto exchange, based in San Francisco. It has been around for like forever (which in the crypto world means since 2011). Kraken is regulated in the United States by the Financial Crimes Enforcement Network (FinCEN). This adds a layer of security and comfort to its users.

The crypto market generally refers to Kraken as a very reliable exchange. The exchange itself states that it exists for “those who demand fast execution, innovative features, exceptional support, and high security” and that it “always put the client first”. Kraken also promotes itself as the most trusted crypto exchange in the world.

New Kraken App

Kraken also released a new app in January 2022. It's not so new now when this review is last updated (24 January 2023), but the promotional video that Kraken released in conjunction with the app's release still contains relevant information. We like it! (in English, 1 minute and 24 seconds)

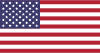

Kraken - A Major Player in The Crypto World

Kraken is, and has always been, one of the major players in the crypto exchange industry. On the date of last updating this review (24 January 2023), it had a 24 hour spot trading volume amounting to USD 605 million, placing it among the top 30 exchanges in Coinmarketcap.com's list of exchanges listed in order of highest 24 hour spot trading volume. It is however top 3, in Coinmarketcap.com's list of reliable spot trading volume scores, surpassed only by Binance (who owns Coinmarketcap.com) and Coinbase:

Mt. Gox Assistance

An example of this exchange’s reliability is that the bankruptcy trustee of Mt. Gox appointed Kraken to assist in processing the claims of the 127,000 creditors of Mt. Gox. Its duties in that process were the following:

- Aid in the investigation of possible lost or stolen Bitcoin

- Aid in the creation of a system to file and investigate claims

- Help to distribute Bitcoin and/or fiat assets to creditors

- Exchange Bitcoin to fiat currency when needed.

Kraken Staking Services

Kraken is also among the crypto exchanges out there that offer so called staking services. They offer staking for 11 different cryptos; Cardano, Cosmos, Ethereum, Flow, Kava, Kusama, Mina, Polkadot, Solana, Tezos and Tron. The estimated APY (Annual Percentage Yield) offered by Kraken ranges from 3.00% to 21.00%, dependent upon which crypto you want to stake and which staking period you decide to have.

You can start staking at their platform here.

If you’re interested in learning more about staking, the various staking types and where you can get the best staking rates, you can also have a look at our extensive Guide To Ethereum Staking.

OTC-desk

Kraken also has an OTC-desk function. With an OTC-desk (acronym for Over The Counter), you can execute larger trades without any risk of “slippage”, which is what we call price movements due to large transactions.

At Kraken, the minimum order size is USD 100,000, so it’s not for the small players. But if you have trades in that size, Kraken’s OTC-desk offers deep liquidity and a private, more personalized service. The service is primarily aimed at high net-worth individuals, institutions and crypto firms that need to fill large orders efficiently. The execution and settlement services are discrete, secure and ultra-competitive.

Kraken has a dedicated team of 11 professional traders throughout North America, Europe and Asia Pacific, so that the platform can “understand your specific geographical market needs” and can trade and settle fast and efficiently around the clock. Kraken’s EU-team has traders located in London as well as dedicated account management and sales support to take care of all your trading needs.

Mobile Support

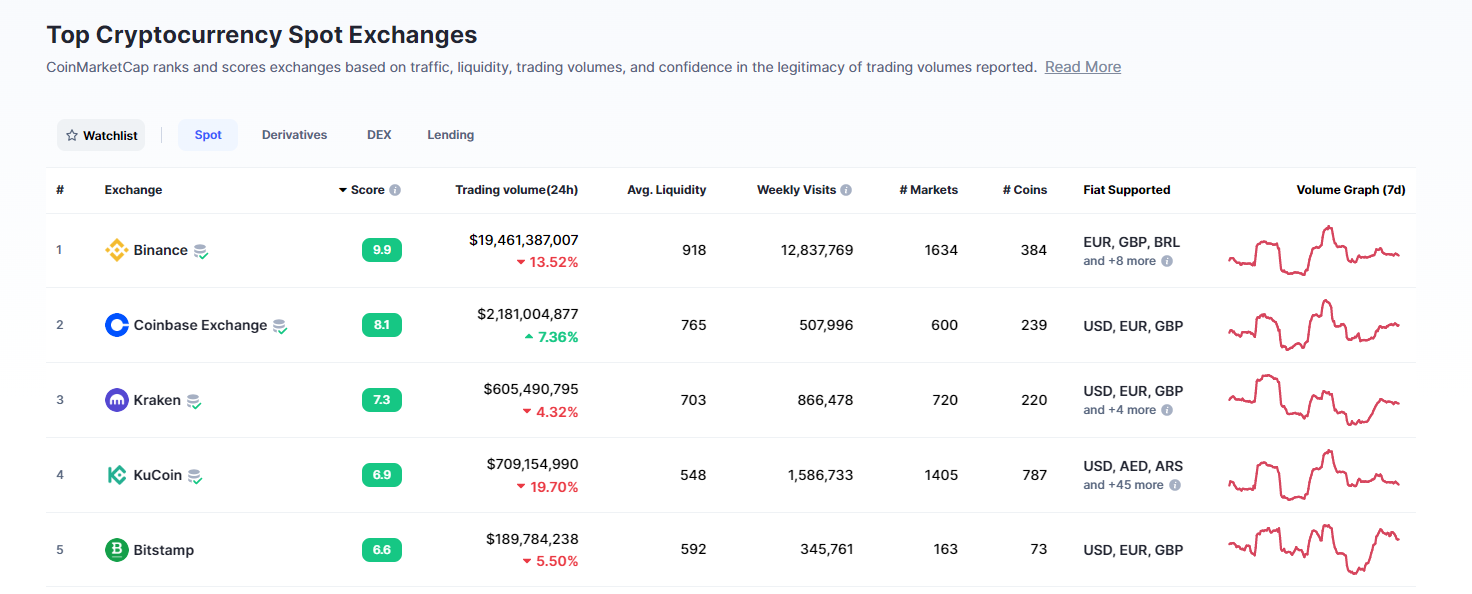

Like most other platforms out there today, Kraken is also available as a mobile app. This means that you no longer need a desktop to access the crypto trading world. As long as you can download apps from App Store or Google Play, you’re good to go.

Leveraged Trading

Kraken also offers leveraged trading. This offering was launched after the company bought Crypto Facilities, a trading platform that they themselves describe as a “world-leading, FCA-regulated” trading platform. The purchase price has not been disclosed but is allegedly above USD 100,000,000 – constituting one of the biggest acquisitions in the history of crypto. After the acquisition, you can now seamlessly move funds between Kraken Exchange and Kraken futures.

At Kraken, you can trade with leverage up to 50x on the top five cryptos. There are other platforms offering up to 100x and Coinbase Pro even offers up to 500x. At Kraken, there are no capacity restrictions and no ongoing interest charges. Kraken also highlights that there are “seamless transfers between spot and futures markets” and that they have a 30% revenue share. The latter meaning that the exchange pays out 30% of all the net fees that they have collected from their active traders, back to the traders.

Kraken Trading View

All exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views tend to have in common is that they all show the order book or at least part of the order book, a price chart of the chosen crypto and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can see that it feels right to you. The below is a picture of the trading view at Kraken Pro (printscreen from 24 January 2023):

Kraken Fees

Kraken Trading fees

Kraken’s trading fees for takers are 0.26%, and for makers 0.16%. This fee is ever so slightly above the industry average for takers, and ever so slightly below the industry average for makers. According to this report, the industry average spot trading fee was 0.2294% for takers and 0.1854% for makers.

At Kraken, you will also receive discounts on your trading fees if you reach certain trading volume thresholds. This is quite common among the bigger cryptocurrency exchanges. The discount table looks as follows (as of 24 January 2023):

Kraken Withdrawal fees

Withdrawal fees are typically a fixed fee of the relevant crypto you want to withdraw. This fixed fee is the same, regardless of how big the withdrawal is. For certain platforms, you can increase this fee to give the transaction a higher priority.

Kraken charges a withdrawal fee amounting to 0.0002 BTC when you withdraw BTC. This fee is below the global industry average, which - the last time we made an empirical study on the subject - was 0.0004599 BTC per BTC-withdrawal.

Deposit Methods and US-investors

US-investors

As the exchange is American, you can trade here if you are a US-investor.

Deposit Methods

You can deposit money to Kraken in a very wide variety of ways. For instance, you can pay for cryptos at Kraken with Apple Pay and Google Pay. Simply choose the cryptocurrency you'd like to buy, enter the amount, and select Apple or Google Pay from the "Pay With" menu. If you don't yet have a card added, you can add one right from the Kraken app.

Another option you have when it comes to the deposits is to deposit (and withdraw) USD, EUR, CAD, GBP and JPY through Etana Custody (and CHF through Bank Frick in Liechtenstein). Etana offers currency conversion for a wide range of fiat currencies. Users of the Kraken platform can wire transfer almost any fiat currency to their Etana Custody wallet, and then exchange that into one of the five major fiat currencies that the Kraken platform supports, in order to fund their respective Kraken accounts.

You can also deposit and withdraw EUR via SEPA-transfers. Kraken’s cooperation with Liechtenstein-based Bank Frick makes this possible. The SEPA-deposit fees are EUR 0.15 and the SEPA-withdrawal fees are EUR 1.00 (so next to nothing, really).

FAQs

Are Kraken's fees high?

Kraken's fees are not particularly low to be honest. When spot trading at Kraken, takers pay 0.26% and makers pay 0.16%. 0.26% is unarguably above industry average, while 0.16% is ever so slightly below industry average. For contract trading at Kraken, fees are however more competitive as takers pay 0.05% and makers pay 0.02%.

What is the minimum deposit on Kraken?

There are minimum deposit requirements at Kraken, but they are very low. For instance, if you deposit Bitcoin, the minimum deposit is 0.0001 BTC (at the date of writing this FAQ, 14 February 2023, corresponding to USD 2.20).

How long is the withdrawal time at Kraken?

According to the exchange, crypto withdrawals here take on average around 20 minutes. 10 minutes for internal checks, and then 10 minutes to be sent to the payment gateway and processed.

Has Kraken ever been hacked?

On the date of answering this question, 14 February 2023, Kraken has never been hacked.

Is Kraken secure?

Kraken is most definitely a secure platform.

Where is Kraken based?

Kraken is based in San Francisco, California, USA.

Which countries are restricted from using Kraken?

Kraken is different from most other platforms in the way that it does not say on its website that they DO NOT allow users from certain countries. They only list all countries that they DO allow users from. Then, in that list of allowed countries, they note certain restrictions. However, we have managed to conclude that the following countries/regions are not listed as permitted on Kraken's website: Afghanistan, Cuba, Crimea, Donetsk, Iran, Iraq, Japan, Luhansk, Sevastopol, Syria, North Korea, and South Korea. The following groups are the groups of countries where the users ARE permitted, but with restrictions (A) Users from Burundi, Belarus, Central African Republic, Eritrea, Guinea-Bissau, Lebanon, Mali, Myanmar, Namibia, Nicaragua, Somalia, South Sudan, Sudan, Venezuela, Yemen and Zimbabwe can open an account, but may be restricted from funding. (B) Users from Australia, Hong Kong, Singapore, the United Arab Emirates and the United Kingdom can use all services at the Kraken platform except for the so called Opt-In Rewards. (C) Users from Italy, Spain and retail-clients in the United Kingdom and Australia, can use all services at the Kraken platform except for futures trading.