CEX.IO

Exchange Fees

Deposit Methods

Cryptos (117)

CEX.IO Review

What is CEX.IO?

CEX.IO is a cryptocurrency exchange that has been registered as Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN), a bureau of the US Department of the Treasury. They have been active since 2013, which is almost an eternity in the crypto world, and they proudly state that they have more than 5 million users registered globally.

Here's an overview that the platform has posted on its website, showing the development 2012-2022:

CEX.IO Advantages

The exchange lists the following 9 factors as reasons to choose CEX.IO as your trading platform.

US-investors

This exchange is open to US-investors from 48 states in America. They have Money Transmitter Licenses (MTLs) in 32 US states, and they are allegedly constantly working on covering more.

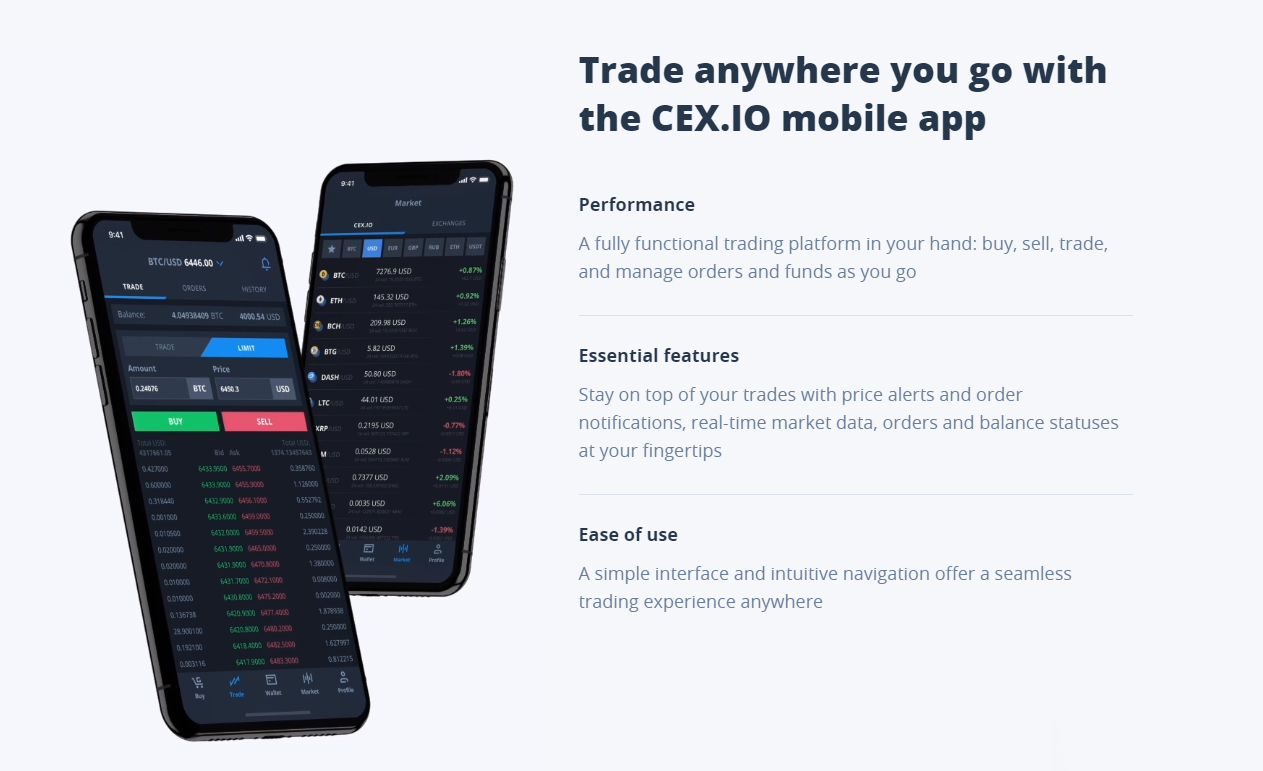

Mobile Support

This platform is not only available from your desktop, you can also access it via your mobile browser. Most traders in the crypto world today carry out their trades via desktop (around 70% or so). However, there are of course people out there that want to do it from their smart phone as well. If you’re one of those people, then this platform can still be for you.

Leveraged Trading

CEX.IO offers leveraged trading on its trading platform. This means that you can receive a higher exposure towards a certain cryptocurrency’s price increase or decrease, without having the assets necessary. You do this by “leveraging” your trade, which in simple terms essentially means that you borrow from the exchange to bet more. CEX.IO also has a platform they call CEX.IO Broker, where you can engage in leveraged trading in an even wider variety of assets, including forex, stocks and metals.

For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., increasing in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD. As you bet 100 USD with 100x leverage, you have instead earned an additional 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC decreases in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

CEX.IO Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book. Or, at least part of the order book. They also show a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at CEX.IO:

CEX.IO Fees

CEX.IO Trading fees

The one thing we can’t stress enough is that you must always ascertain the trading fees at any exchange you are interested in. Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. Makers make the liquidity in a market and takers remove this liquidity by matching makers’ orders with their own.

CEX.IO’s trading fees for takers are 0.25%. The exchange also offers a discount to makers, who trade at a fee of 0.15%. This is especially beneficial for the investors not interested in picking up existing orders from the order book. According to the most extensive industry report on trading fees, the industry average taker fee was 0.2294% during the second quarter of 2022, and the industry average maker fee was 0.1854%. This means that CEX.io's fees are slightly below average.

Finally, the trading fees are reduced as the trader increases trading volumes. They can go down to as low as 0.01% for takers and 0.00% for makers (if your 30-day trading volume is 5 billion USD or more...). This is the full table of trading fee discounts:

CEX.IO Withdrawal fees

CEX.IO charges a withdrawal fee amounting to 0.0005 BTC when you withdraw BTC. This is a bit higher than the industry average, as the industry average is 0.0004599 BTC per BTC-withdrawal.

All in all, the fees charged by CEX.IO are quite in line with the global industry averages.

Deposit Methods

At CEX.IO, you can deposit through many different ways, including wire transfer and debit card. This can be helpful especially for newer crypto investors putting in their first funds in the crypto world. As a matter of fact, CEX.IO was actually one of the first cryptocurrency exchanges in the world offering the choice to buy crypto via credit card. Here's an overview of some of the available methods, including minimum and maximum deposit limits and the fees involved with each deposit method:

There are a lot of people using the credit card deposit alternative. According to CEX.IO, it is actually one of the most popular ways (with a record of USD 180 million in deposits one single month).

Please be advised though that on the date of last updating this review (15 January 2023), card payments were not available to individuals from the following countries:

"Afghanistan, Algeria, Bangladesh, Bolivia, Bosnia and Herzegovina, British Virgin Islands, Burundi, Cambodia, Central African Republic, China, Cuba, Democratic People's Republic of Korea (DPRK), Democratic Republic of the Congo, Ethiopia, Guam, Guinea Bissau, Guyana, Iran, Iraq, Japan, Lao People's Democratic Republic, Lebanon, Libya, Mali, Morocco, Nepal, Pakistan, Puerto Rico, Somalia, South Sudan, Sudan, Syria, Trinidad and Tobago, Tunisia, Uganda, United States Virgin Islands, Vanuatu, Venezuela, Yemen, Zimbabwe."