Changelly

Exchange Fees

Deposit Methods

Cryptos (310)

Changelly Review

What is Changelly?

Changelly is an instant crypto exchange that launched in 2015. It was previously headquartered in the Czech Republic, but is now based in Hong Kong with a offices at various locations around the world, e.g. Malta, Great Britain and Brazil.

Ownership and Management

The group initially behind Changelly is MinerGate, which is a team with long track records on the crypto market. MinerGate have no involvement in Changelly’s current operations however. The current CEO of the company is Eric Benz, who replaced Ilya Bere (who was previously the COO when Konstantin Gladych ran the company). Eric Benz has five years of experience working in the innovative financial technology and blockchain field.

How does it work at Changelly?

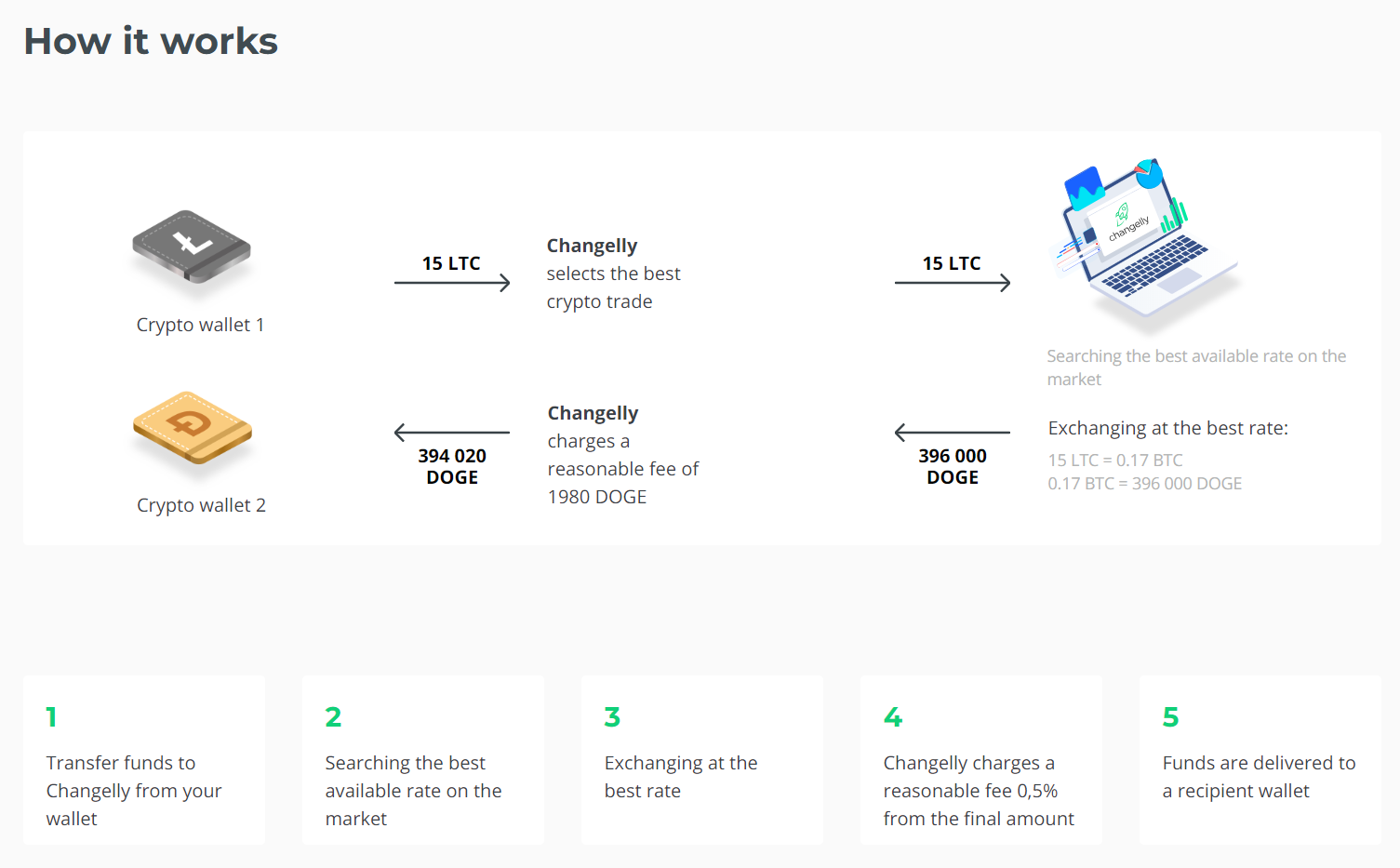

Changelly is one of the best exchanges when it comes to finding the best available rates for the different trading pairs on the market. To be clear though, Changelly is not an exchange per se, it is a crypto exchange service. The platform is non-custodial, meaning that when you purchase cryptos on Changelly, what you’re doing is buying crypto from another exchange. Changelly provides you with a window into other exchanges (Binance, Bittrex, Poloniex and HitBTC), all so that they can provide the best price for you.

The infographic below expands in detail on how it all works:

The exchange has over 150 cryptocurrencies listed and focuses on crypto-to-crypto trading. It is also possible to buy crypto with fiat using Changelly’s card payment partners Simplex and Indacoin. Fiat-to-crypto transactions are processed in a different way than crypto-to-crypto exchanges (KYC, higher service fees, etc.).

Primary Advantages

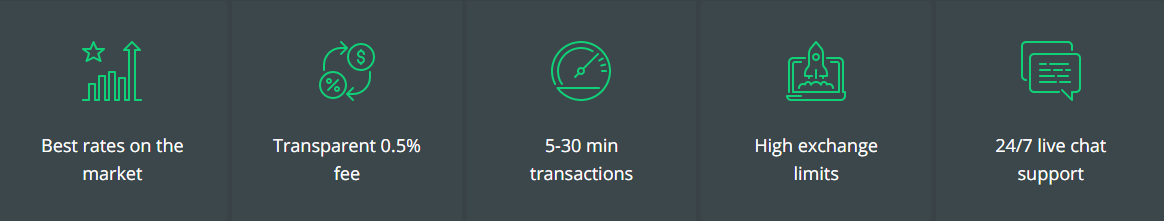

Changelly lists five primary advantages of its trading platform on its landing page: the best rates on the market, transparency in fees, fast transaction speed, high limits and 24/7 support.

In our opinion, these advantages are all strong advantages. In particular, we like that Changelly’s gateway structure helps the trader find the best rates, that they have transparent fees and that they have support staff responding to user requests through an online live chat 24 hours a day, seven days a week. Very impressive, indeed.

Changelly Affiliate Program

If you refer a friend to Changelly, you will receive 50% of the fees from every transaction your friend makes within the promotion period. This deal is not time-limited either but is permanent. There are two ways to take part in the Changelly affiliate program: Changelly widget and an exchange button with a referral link, and you are welcome to choose the one that suits you the most.

The 50% revenue share model works for 90 days since your referred friend’s registration. This is actually an unusually short referral period. Most exchanges out there offer permanent commission payments, meaning that you will never stop receiving commissions from a referred friend who keeps on trading. That was Changelly’s model previously as well, but it has now been changed to the worse. So, at this particular point, Changelly has a weak offering to its users.

Changelly Tools

In October 2019, the exchange released a new version of the mobile app with the fixed-rate mechanism onboard for both Android and iOS, so users can swap their assets avoiding the risks of the market fluctuations. For those who would like to exchange crypto at a floating rate, the service offers one of the lowest transaction fees on the market – 0.25% for all crypto-to-crypto exchanges. In addition to all these features, users also have the ability to buy crypto assets with a bank card right from the mobile app (currently available for Android users only) and explore crypto exchange rates in real-time mode.

In addition to the features mentioned earlier, Changelly mobile app gives users the ability to log in to their original website account, track their transaction history, store an address list for their most used wallets as well as get quick assistance from the Changelly team in the support section.

Changelly also offers its API and a customizable payment widget to any crypto service that wishes to broaden its audience and implement new exchange options. For instance, many wallets are using this feature inside their web/desktop/mobile applications, such as Ledger, Trezor, Exodus, Coinomi, Enjin and many others.

Changelly Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-perspective. You should determine which trading view that suits you the best. The “trading view” at Changelly is much simpler and more intuitive than at a regular centralized exchange. This is because Changelly is more of an exchange service than an actual exchange. The below picture shows the interface when you want to trade BTC for ETH:

Restricted Jurisdictions

You may not trade at Changelly if you are from USA, Cuba, Iran, North Korea, Crimea, Sudan, Syria, Bangladesh or Bolivia, as well as any other country subject to United Nations Security Council Sanctions List and its equivalent. But don’t despair, if you’re from any of those countries you might be able to find an exchange for you by just using our Exchange Finder.

Changelly has the AML/KYC procedure implemented into their service. It means that the exchange sometimes may ask users to show “proof-of-funds” and go through the KYC check if Changelly’s automated risk management system marked those transactions as suspicious. But, users are warned about this with a checkbox alert before they send funds to the exchange.

Changelly Fees

Changelly Trading fees

This particular platform offers you the opportunity to swiftly and securely buy or sell crypto. This means that there are no charting tools, no order books, or anything like that. The trading view is the purchase interface included above in this review.

When buying at the platform, the purchase price offered by Changelly will be higher than the market price. Conversely, when selling to the platform, the purchase price offered will be lower than the market price. The mark-up or mark-down is not specified anywhere. On the date of last updating this review (9 December 2020), we made a calculation by comparing the prices offered by Changelly to the market prices listed by Coinmarketcap.com. The comparison showed that Changelly's prices were 0.86% higher/lower than Coinmarketcap's market price.

For comparison purposes in our Exchange List, we have used that mark-up/mark-down as the taker and maker fee in our database.

It is difficult to compare the fees charged by Changelly with the industry average trading fee at a regular centralized exchange (0.213% for takers and 0.16% for makers), seeing as they offer another type of service than most centralized exchanges do. But to conclude on the trading fees, there are definitely cheaper ways to obtain crypto than through using the Changelly platform. Changelly's advantages are speed and convenience, rather than price.

Changelly Withdrawal fees

Many exchanges have low trading fees but then on the way out hit you with their high withdrawal fees. Changelly charges only 0.0001 BTC for BTC-withdrawals. The global industry average BTC-withdrawal fee is 0.000812 BTC per each BTC-withdrawal, and Changelly charges only 12% of that.

Good job, Changelly!

Deposit Methods

You can deposit your funds through regular fiat transfer via Changelly’s corporate partners using credit cards (VISA and MasterCard). This can be especially helpful to novice crypto investors who want a broad selection of deposit methods to be available. Many exchanges offer no fiat currency deposit method at all so Changelly does distinguish itself by offering that.

Also, Changelly recently announced that they lowered the entrance barriers for crypto-to-crypto exchanges. For example, the minimum sum required to exchange Bitcoin to Ethereum is as of today (31 October 2019) only 0.0003 BTC.

Changelly Verification

In order to use this exchange’s conversion services, you do not need to submit the classic KYC-documentation (passports, utility bills or the like). On the contrary, you only need a valid wallet address. If you would rather purchase cryptocurrencies with any form of fiat currency, e.g., a credit card, then additional documentation might be required. But for cryptocurrency conversions, a valid wallet address will suffice.

As mentioned above, there are however exceptions to this rule.