KuCoin

Exchange Fees

Deposit Methods

Cryptos (639)

KuCoin Review

What is KuCoin?

KuCoin is a cryptocurrency exchange based in the Seychelles (previously Hong Kong). The platform launched in September 2017, and on 19 July 2022, they proudly announced that they had reached more than 20 million users registered at the platform, from over 200 different countries/regions. Wow. Often known as the People’s Exchange, KuCoin now offers crypto-related services like crypto-to-crypto, fiat-to-crypto, futures trading, staking, lending and so forth.

The exchange has one of the world’s most impressive trading pair selections, with more than 540 supported coins and 960+ trading pairs. Here's a video showing a few features on the mobile version of the platform:

Kucoin Video Review

Tired of reading the rest of the review? No problem, check out the summary of it all in our video review of KuCoin here:

Trading Volume 21 January 2023

KuCoin regularly ranks among the top 10 crypto exchanges in terms of 24-hour spot trading volume. On the date of the last updating this review (21 January 2023), the 24-hour trading volume was USD 1.02 billion, according to Coinmarketcap. This placed KuCoin on place no. 19 in the Coinmarketcap-list over the exchanges in the world with the highest 24 hour-spot trading volume.

Have Friends - Get Paid

KuCoin also has en affiliate program, through which existing users can refer new users and then earn a commission from the trading of the referred users. And it's a great program too. According to information on the platform's website, there are currently over 16,000 affiliates referring friends to Kucoin and over USD 50 million has been paid out historically. The referring user receives 50% of all the trading fees generated by the referred user. This means that if you (user A) refer a friend (user B), and user B starts trading on the platform, you will receive 50% of user B's trading fees - forever.

You can sign up to the referral program here.

Mobile Support

Most crypto traders feel that desktop give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that KuCoin’s trading platform is also mobile compatible. You can download it to/from both the AppStore, Google Play and Android.

KuCoin Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at KuCoin, obtained on 21 January 2023:

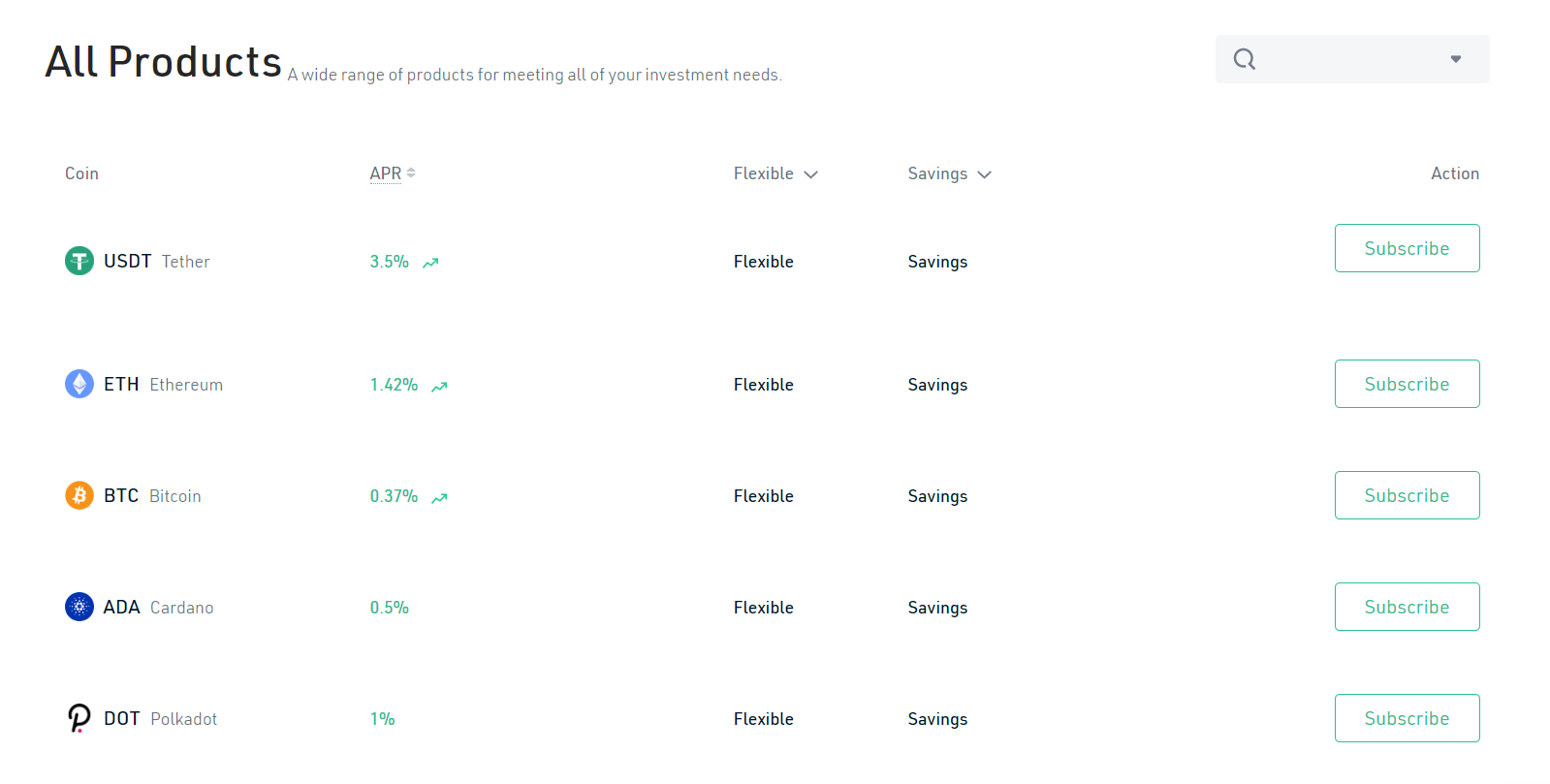

KuCoin Staking Platform

KuCoin is also among the crypto exchanges out there that offer so called staking services. Different from many other platforms, KuCoin has a very wide selection that you can stake. Your staking is not limited to only the bigger coins, like ETH, USDT and BTC, but also many smaller altcoins are possible to stake here. The below table shows a selection of coins and their respective APY (in the picture noted as APR, Annual Percentage Rate) at KuCoin, where the staking period has been set to “flexible”:

You can start staking at their platform here.

If you’re interested in learning more about staking, the various staking types and where you can get the best staking rates, you can also have a look at our extensive Guide To Ethereum Staking.

KuCoin Margin Trading

KuCoin also offer Margin Trading Services. Via this service, traders are able to use funds provided by other users on KuCoin to gain access to larger sums of capital, allowing them to leverage positions. This trading method can be used for both long and short positions. Using “borrowed” funds can increase profit, but on the flip side can also result in larger losses than the initial investment made.

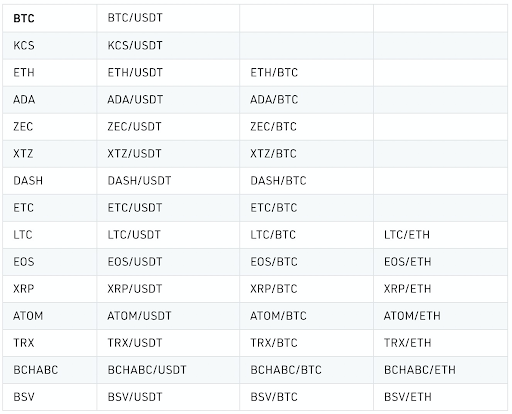

The following shows some of the supported assets and trading pairs in the margin trading:

KuCoin Futures Trading

KuCoin also offers futures trading (also known as contract trading), which is buying and selling the standardized future contracts of commodities or financial assets. According to this future contract, the buyer will buy into assets at a predetermined price at a specified time (named delivery date) in the future, and the seller needs to deliver the asset at the predetermined price at the delivery date.

The KuCoin futures trading platform offers over 60+ cryptocurrencies’ perpetual contracts and, according to information received from KuCoin, the total number of users has already exceeded 3 million.

KuCoin charges the following fees for their futures trading (table obtained on 21 January 2023):

OTC Trading Desk

There is an OTC Trading Desk (OTC is short for Over-The-Counter) available the platform as well. Traders can execute larger trades at a certain price without causing any fluctuations in the price of that cryptocurrency.

In this OTC Trading Desk, it supports the direct purchase of USDT, BTC and other cryptocurrencies using CNY, VND, IDR and CAD. There are no trading fees and quick settlement. Users simply need to complete KYC verification and set up a trading password to start OTC trading.

KCS (KuCoin Shares)

It should also be noted that the exchange has so called KuCoin Shares (KCS), i.e., its native token. If you are a holder of 6 or more KuCoin Shares, you can receive KCS bonus on a daily basis. You can also receive trading discounts and even lower withdrawal fees than otherwise. The exchange also states that KCS-holders can participate in various votings and listings.

KuCoin Fees

KuCoin Trading fees

Many exchanges charge what we call taker fees, from the takers (people grabbing deals from the order book), and what we call maker fees, from the makers (people creating orders in the order book that are not immediately matched with a corresponding order). The main alternative to this is to simply charge “flat” fees. Flat fees mean that the exchange charges the taker and the maker the same fee.

KuCoin charges a flat fee of 0.10% per trade for most trading pairs. This is slightly below the global industry average, being 0.2294% for takers and 0.1854% for makers according to this empirical study.

If you pay the trading fees with KCS, you could get a 20% discount. The trading fees are reduced based on trading volume and holdings last 30-day of KuCoin’s native token, the KCS, as set out in the below table (obtained on 21 January 2023):

KuCoin Withdrawal fees

KuCoin charges a withdrawal fee amounting to 0.0005 BTC when you withdraw BTC. This is quite in line with the global industry average BTC-withdrawal fee, being 0.0004599 BTC according to this empirical study.

All in all, both the trading fees and withdrawal fees at KuCoin are in line with or even below the industry averages, which is great.

Deposit Methods and US-investors

US-investors

US-investors are not listed as prohibited from trading. If you are a US-investor, however, you should still always analyse yourself whether your home state imposes any obstacles for your foreign cryptocurrency trading.

Deposit Methods

Previously, KuCoin only accepted deposits of cryptocurrencies and it did not accept any deposits of fiat currency. Today, however, both card payments and bank transfers are possible here. This makes KuCoin one of the "entry-level exchanges" out there, through which new crypto investors can take their first steps into the thrilling crypto world.

FAQs

Are KuCoin's fees high?

The fees charged by KuCoin are lower than the industry average and very competitive. When spot trading, you pay 0.10% per order. When contract trading, you pay 0.06% if you are a taker and 0.02% if you are a maker.

What is the minimum deposit on KuCoin?

KuCoin has no minimum deposit requirement when you deposit cryptocurrency. However, if you purchase crypto with fiat currency at KuCoin, the minimum purchase is 5 USD.

How long is the withdrawal time at KuCoin?

In our experience, withdrawals at KuCoin take on average 2 minutes for USDT (on the TRC20-network) and 6 minutes for ETH.

Has KuCoin ever been hacked?

KuCoin has been hacked, most notoriously on 25 September 2020. It has however been reported that all user assets affected by the hacking was recovered or reimbursed.

Is KuCoin secure?

While KuCoin has been hacked (most notoriously on 25 September 2020), we still think that it is correct to say that KuCoin today, from a user perspective, is secure.

Where is KuCoin based?

KuCoin is based in the Seychelles (previously Hong Kong).

Which countries are restricted from using KuCoin?

To be honest, we don't know. In their Terms of Use, KuCoin says that you can't open an account at the platform if you are a "resident of or registered in, any of the jurisdictions that the Platform has deemed to be high risk (such list may be updated from time to time at the Platform’s sole and absolute discretion)". But the list is nowhere to be found. If we were to guess which countries that are disallowed, it would be: Afghanistan, Burundi, Central African Republic, Congo, Mainland China, Cuba, Ethiopia, Guinea, Guinea-Bissau, Iraq, Iran, Lebanon, Libya, orth Korea, Sevastopol, Sudan, Somalia, South Sudan, Syrian Arab Republic, Tunisia, Trinidad and Tobago, Uganda, Venezuela, Yemen, Zimbabwe, Cuba, and Russian-controlled regions of Ukraine (including the Crimea, Donetsk, and Luhansk regions).