BitMart

Exchange Fees

Deposit Methods

Cryptos (175)

BitMart Review

What is BitMart?

BitMart is a crypto exchange from the Cayman Islands. It became available to the public in March 2018 and since then, the platform has served over 9 million users (according to information on its website).

On the date of last updating this review (22 January 2023), BitMart's 24 hour spot trading volume was USD 931 million. This is quite impressive, and in Coinmarketcap.com's list of exchanges based on 24 hour spot trading volume, BitMart took place no. 18.

Introduction to BitMart

Here's a wonderful video clip that BitMart has made for promotional purposes, an introduction to BitMart of sorts.

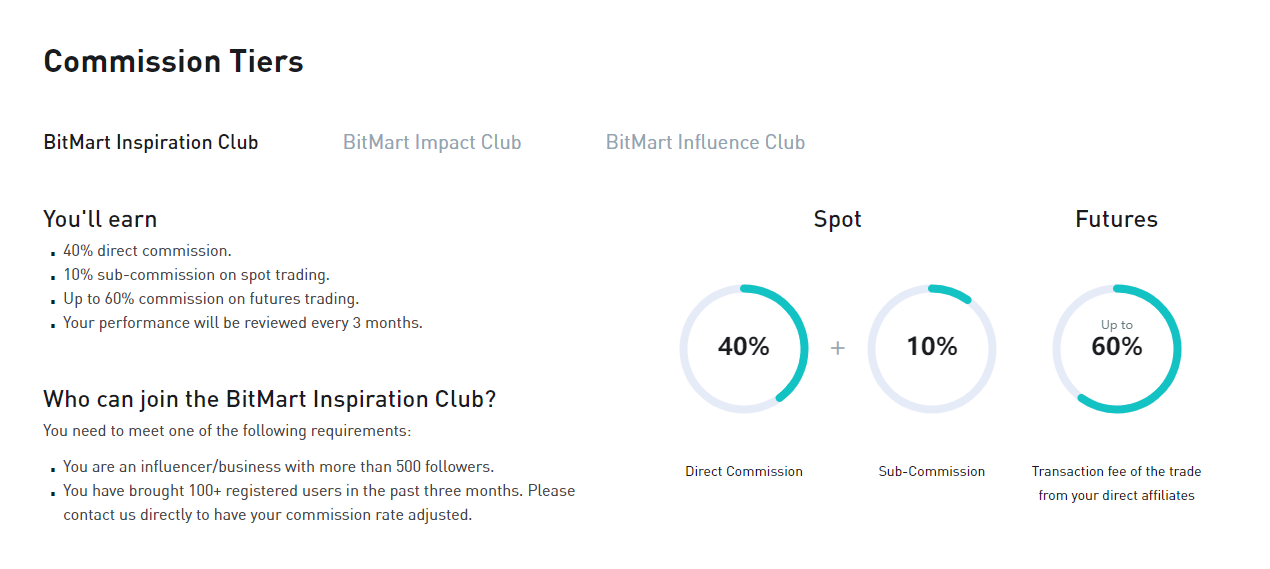

BitMart Affiliate Program

BitMart has an affiliate program in place for its users, through which existing users can refer new users and then earn a commission from the trading of the referred users. Actually, they have three different programs: BitMart Inspiration Club, BitMart Impact Club and BitMart Influence Club.

Your affiliate commission varies dependent upon which program you are in, and whether your referred user trades in the spot market or the futures market. For the standard affiliate program (BitMart Inspiration Club), and in spot trading, you can get 40% from your direct referral, and 10% of his/her referrals. For futures trading, you will only get affiliate commission from your direct referrals but the level is as high as 60%!

You can sign up to BitMart's affiliate program by creating an account here.

Mobile Support

Most crypto traders feel that desktop give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that BitMart’s trading platform is also mobile compatible. You can download it to/from AppStore and Google Play:

BitMart Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the spot trading view at BitMart, obtained on 22 January 2023:

BitMart Lending Product

Another interesting feature of this platform is BitMart Lending. BitMart Lending is a financial product based on digital assets. Each project has its corresponding investment term and yield. After subscription, the principle will be locked, and the interest will be calculated according to the agreed time. After the product matures, the principal and interest will be unlocked and distributed into the user’s wallet on the redemption date.

BitMart Staking Product

Staking is the process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network. Holders are rewarded for simply depositing and holding coins on BitMart as they normally would. Staking at BitMart is available for hundreds of different cryptos, with very different APYs (Annual Percentage Yield), which essentially is the same as interest rates). The following is a snapshot of certain cryptos available for staking on BitMart (obtained on 22 January 2023).

You can start staking at the BitMart-platform here.

If you’re interested in learning more about staking, the various staking types and where you can get the best staking rates, you can also have a look at our extensive Guide To Ethereum Staking.

BitMart Futures

BitMart also offer futures trading. Among other things, they offer “perpetual swaps” on the platform. Perpetual swaps refer to a kind of derivative that is similar to traditional futures contract and can provide high leverage. It differs from traditional futures contract in the following aspects:

It has no delivery date. Perpetual contracts don’t have any expiration times, so it doesn’t impose any limit on the position-holding duration.

It has an anchored spot market. In order to guarantee tracking underlying price index, perpetual contracts ensure that their prices follow the price of the underlying assets through the mechanism of funding cost.

It has reasonable price marking. The perpetual contracts adopt reasonable price marking methods. This is to avoid forced liquidation due to lack of liquidity or manipulation of the market.

It has an auto deleveraging (ADL) mechanism. Perpetual contract use an ADL mechanism instead of an account sharing mechanism. This is in order to deal with the losses caused by forced liquidation of big positions.

BitMart Fees

BitMart Trading fees

Trading fees are naturally very important. Every time you place an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. At this exchange, they do not divide between takers and makers. Takers are the one who “take” an existing order from the order book, while makers “make” the orders that get taken.

BitMart doesn't distinguish between takers and makers. Instead, they charge 0.25% regardless of which side of the trade you are on. We call this "flat fees". The trading fees are also reduced based on trading volume and holdings of BitMart’s native token, the BMX, as set out in the below table:

0.25% is actually a bit above the global industry average for spot trading. According to this report, the global industry average spot trading taker fee was 0.2294% and the corresponding maker fee was 0.1854%. So BitMart is above average in both respects.

BitMart Withdrawal fees

This exchange charges a withdrawal fee amounting to 0.0005 BTC when you withdraw BTC. This fee is quite in line with industry average, being 0.0004599 BTC per BTC-withdrawal (source: this report).

Deposit Methods and US-investors

US-investors

Many exchanges does not allow investors from USA as customers. As far as we can tell, BitMart is not one of those exchanges. Any US-investors interested in trading here should in any event form their own opinion on any issues arising from their citizenship or residency.

Deposit Methods

At this exchange, you can purchase crypto through payment cards (VISA and MasterCard). This can be helpful especially for newer crypto investors who want a broad selection of available deposit methods. Many exchanges offer no fiat currency deposit method at all so BitMart does distinguish itself somewhat by even offering card payment possibilities.

Finally, here's a few bonus offers at BitMart (available on 22 January 2023) that an interested reader of this review might find attractive. Good luck!

FAQs

Are BitMart's fees high?

BitMart charges a flat fee of 0.25% per spot order. This fee is quite in line with the industry average. When contract trading, you pay 0.06% if you are a taker and 0.02% if you are a maker, and both of these fees are below industry average.

What is the minimum deposit on BitMart?

To our knowledge, BitMart does not have any minimum deposit requirements.

How long is the withdrawal time at BitMart?

According to the exchange, crypto withdrawals take between 5 seconds - 60 minutes, dependent upon which crypto you wish to withdraw and such crypto's associated network pressures and processing times.

Has BitMart ever been hacked?

BitMart was hacked on 3 December 2021. Hackers got away with almost USD 200 million. It has however been reported that all user assets affected by the hacking was recovered or reimbursed.

Is BitMart secure?

While BitMart has been hacked in the past (on 3 December 2021), we still think that it is correct to say that BitMart today, from a user perspective, is secure.

Where is BitMart based?

BitMart is based in the Cayman Islands.

Which countries are restricted from using BitMart?

At this time (16 February 2023), BitMart does not provide services to residents of: Afghanistan, Balkans, Belarus, Burma, China (Mainland), Cote D’Ivoire (Ivory Coast), Cuba, Crimea, Democratic Republic of Congo, Iran, Iraq, Liberia, North Korea, Sudan, Syria, Zimbabwe and the State of New York.