BitMEX

Exchange Fees

Deposit Methods

Cryptos (24)

INSIDE TIP: If you sign up using this link, you will get a USD 25 deposit bonus when you have verified your account.

BitMEX Review

What is BitMEX?

BitMEX is one of the world’s biggest derivatives exchanges with a strong and secure platform. It has been active since 2014 and its place of registration is the Seychelles.

Trading Volume

BitMEX has an impressive trading volume. On the date of last updating this review (2 December 2021), the exchange had a 24-hour trading volume of USD 1.5 billion according to Coinmarketcap. In comparison, the same value on 21 September 2021 was USD 3.81 billion.

Restricted Investors

US-investors may not trade here, at least not today. So, if you’re an investor based in the US and you’re looking for a crypto exchange, use our Exchange Finder to find out which alternatives you have.

On 28 April 2020, BitMEX also announced that they will no longer be open to Japanese Investors.

BitMEX Corporate

In an email to its users on 23 June 2020, BitMEX introduced that they would now offer an improved offering for its corporate users, simply called "BitMEX Corporate". The benefits of the corporate program is, according to the email, the following:

- Enhanced Service: Dedicated client coverage relationship manager and access to global corporate events

- Enhanced Security: Additional options for defining account access and control via authorised signatories and dedicated account management

- Accounting Requirements: Clarify account ownership and domicile

- Audit: Access to our Account Audit features and support

BitMEX Trading Platform

BitMEX trading platform is written in the coumn-store database kdb+. This is the same type of database that many banks use in their high-frequency trading platforms. Partly pursuant to this, the BitMEX platform is extremely fast and reliable. Much more so than many of its competitors, e.g. Poloniex. This is how their trading view looks:

From our perspective, the trading view makes sense. You have the diagrams in the middle, the history to the right, and the current order book to the left. It’s an easy overview. Also, this exchange’s mobile implementation is fully-fledged. The picture above is the standard setting but you can also activate the “night mode” if that is more soothing to your eyes or your experience.

Leveraged Trading

BitMEX also offers leveraged trading. On BTC, you can get leveraged maximum 100x (on spot and futures), both when going long and going short. This can lead to massive returns but – on the contrary – also to massive losses.

For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., increasing in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD. As you bet 100 USD with 100x leverage, you have instead earned an additional 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC decreases in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, there is potential for huge upside but also for huge downside…

BitMEX Fees

BitMEX’s fees consist of deposit fees, trading fees and withdrawal fees.

Deposit fees vary dependent upon how you deposit.

Trading fees are 0.075% of the total order value for takers, but makers get paid 0.025% for making trades. Trading fees for makers is thus -0.025%.

Withdrawal fees correspond to the network fees (approx. 0.000051 BTC for BTC-withdrawals).

BitMEX Trading fees

Always check the trading fees! Before reading the below information it can be worth clarifying the following: what is a taker fee, and what is a maker fee? As your No. 1 trading cryptocurrency guide, we will help you with that.

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. We call makers “makers” because their orders make the liquidity in a market. Takers are the ones who remove this liquidity by matching makers’ orders with their own. The maker-taker model encourages market liquidity by rewarding the makers of that liquidity with a fee discount. It also results in a tighter market spread due to the increased incentive for makers to outbid each other.

BitMEX’s trading fees for takers are 0.075% which is quite standard when it comes to derivatives exchanges. BitMEX also pays you for making maker orders, meaning that they have a negative fee for makers (-0.01%). So if you make a maker order worth USD 100,000 which is picked up by a taker, you get paid USD 10 for providing the liquidity. Sure, USD 10 isn’t that much for an order of that size, but still, you get paid! We are extremely impressed by this.

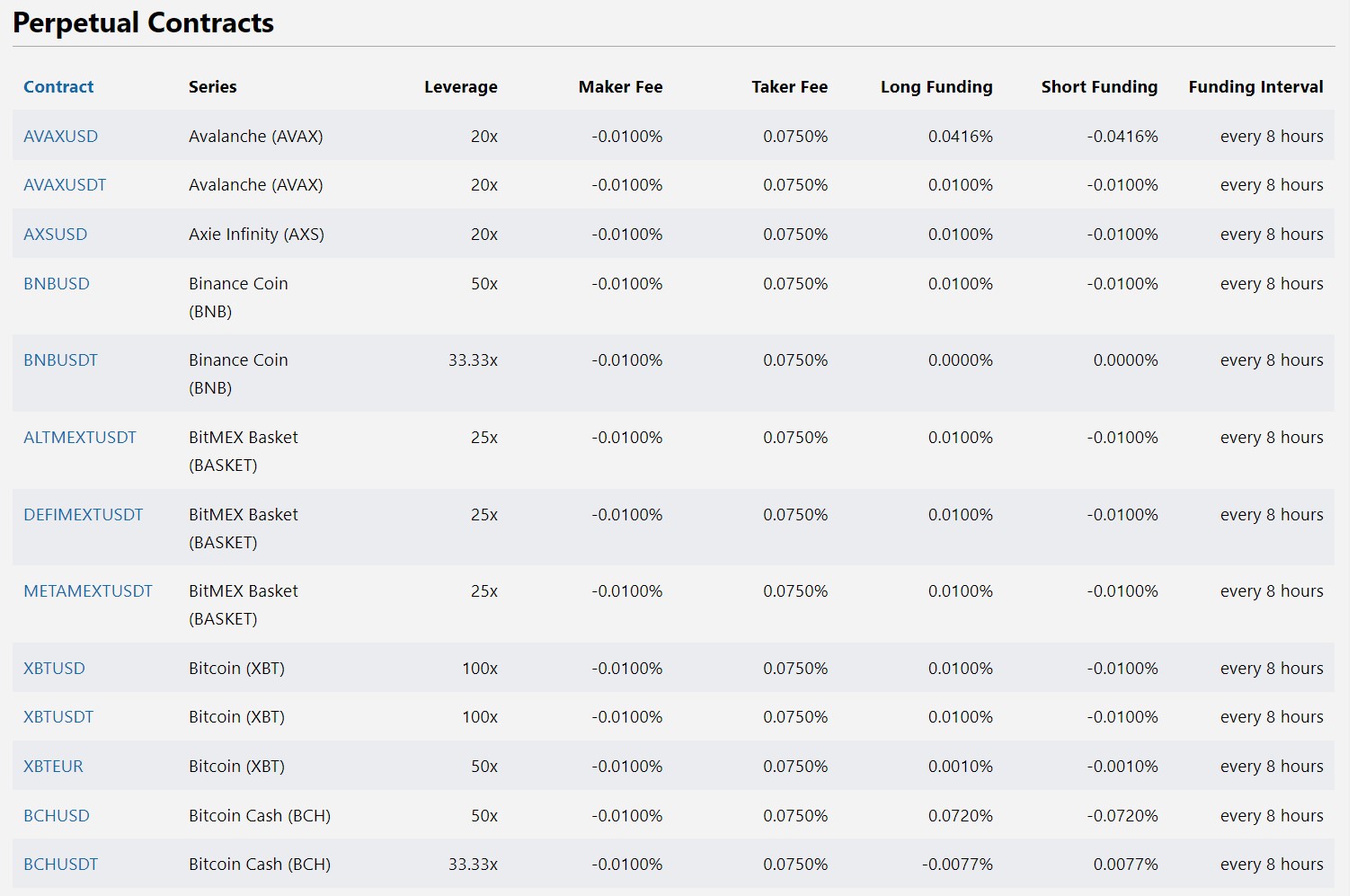

It should be clarified here that BitMEX – unlike most crypto exchanges – mainly focuses on option trading. They divide their fees into the following option contract groups: perpetual contracts, traditional futures, upside profit contracts and downside profit contracts. Here are the fees for the various contracts in the perpetual contracts category:

And here are their fees for traditional futures and quanto futures.

Finally, it might be worth mentioning that you can also receive trading fee discounts by reaching a certain trading volume during the most recent 30 days, as set out in the below table. The lowest level of fees you can have is 0.025% for takers. These fees are quite competitive, but they do require you to achieve a trading volume during the preceding 30 days of more than USD 50 million, so that fee level is surely not available for most traders.

BitMEX Withdrawal fees

OK, you have read this far and you understand the trading fees of this exchange. But wait, there’s more you need to look out for! One very important fee that people easily forget is the withdrawal fee. Let’s say you trade at a top crypto exchange with trading fees that are competitive enough. You have met your investment goals and you are looking to buy house with bitcoin. But in order to buy the house, you need to withdraw the funds. And BAM! – the exchange can make up for its low trading fees at one fell swoop.

Well, not BitMEX. BitMEX only charges the network fee when making withdrawals. This is a very strong competitive edge in the market and really distinguishes BitMEX from most other top crypto exchanges.

Deposit Methods

BitMEX does not accept any other deposit method than cryptos. So, if you are a new crypto investor and you wish to start trading at BitMEX, you will have to purchase cryptos from another exchange first and then deposit them at BitMEX.