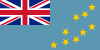

Romania vs Tuvalu

Crypto regulation comparison

Romania

Tuvalu

Legal

No Regulation

Cryptocurrency is legal in Romania. Crypto gains are taxed at 10% as 'income from other sources' under the fiscal code. VASPs must register with the relevant authorities for AML compliance. Romania has a growing crypto community and is transitioning to the EU MiCA framework.

Tuvalu has no specific cryptocurrency regulation. Uses the Australian dollar.

Tax Type

Capital gains

Tax Type

None

Tax Rate

10%

Tax Rate

N/A

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

ASF (Autoritatea de Supraveghere Financiară), BNR (National Bank of Romania)

Regulator

National Bank of Tuvalu

Stablecoin Rules

Regulated under EU MiCA framework

Stablecoin Rules

No stablecoin regulation

Key Points

- Crypto gains taxed at 10% as 'income from other sources' under Article 114 Fiscal Code

- Annual gains up to RON 600 (~EUR 120) exempt from tax per Article 116 Fiscal Code

- VASPs must register for AML/CFT compliance

- ASF oversees financial market conduct; BNR handles monetary policy

- MiCA framework applicable from December 2024

Key Points

- No specific cryptocurrency legislation

- Uses the Australian dollar

- Very limited financial and internet infrastructure

- Minimal crypto adoption

- No licensing framework for crypto services