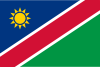

Namibia vs Saint Vincent and the Grenadines

Crypto regulation comparison

Namibia

Saint Vincent and the Grenadines

Legal

Legal

Namibia enacted the Virtual Assets Act (Act 10 of 2023) establishing a comprehensive licensing framework for VASPs. The Bank of Namibia is designated as regulator. Crypto is legal but not legal tender. No specific crypto tax framework yet.

Saint Vincent and the Grenadines has been a popular jurisdiction for offshore crypto businesses. No income or capital gains tax.

Tax Type

No framework

Tax Type

No tax

Tax Rate

N/A

Tax Rate

0%

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

Bank of Namibia

Regulator

Eastern Caribbean Central Bank (ECCB), Financial Services Authority

Stablecoin Rules

Regulated under Virtual Assets Act

Stablecoin Rules

No specific stablecoin regulation

Key Points

- Virtual Assets Act (Act 10 of 2023) signed into law July 2023

- VASPs must obtain licenses from Bank of Namibia to operate

- Provisional licenses granted to first two exchanges in 2025

- Non-compliance penalties up to NAD 10 million and 10 years imprisonment

- Crypto is not legal tender but merchants may accept at their discretion

Key Points

- Popular jurisdiction for crypto business registration

- No income or capital gains tax

- Financial Services Authority provides oversight

- ECCB provides regional monetary oversight

- Several crypto exchanges have been registered here