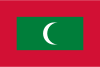

Maldives vs South Africa

Crypto regulation comparison

Maldives

South Africa

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

South Africa has embraced crypto regulation. In 2022, the FSCA declared crypto assets as financial products under the Financial Advisory and Intermediary Services (FAIS) Act, requiring crypto service providers to obtain FSCA licenses. SARS taxes crypto gains under capital gains tax (up to 18% effective rate for individuals) or income tax depending on trading frequency. South Africa is the largest crypto market in Africa.

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption

Key Points

- Crypto declared a financial product under FAIS Act (2022); service providers must be FSCA-licensed

- FSCA began licensing crypto asset service providers (CASPs) in 2023

- Capital gains taxed at effective rate up to 18% (45% max marginal rate × 40% inclusion)

- Frequent trading may be classified as income and taxed at marginal rates (up to 45%)

- SARB regulates cross-border crypto transactions under exchange control regulations