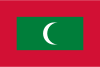

Maldives vs Saint Vincent and the Grenadines

Crypto regulation comparison

Maldives

Saint Vincent and the Grenadines

Restricted

Legal

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Saint Vincent and the Grenadines has been a popular jurisdiction for offshore crypto businesses. No income or capital gains tax.

Tax Type

None

Tax Type

No tax

Tax Rate

N/A

Tax Rate

0%

Exchanges

No

Exchanges

Yes

Mining

No

Mining

Yes

Regulator

Maldives Monetary Authority (MMA)

Regulator

Eastern Caribbean Central Bank (ECCB), Financial Services Authority

Stablecoin Rules

No stablecoin regulation

Stablecoin Rules

No specific stablecoin regulation

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption

Key Points

- Popular jurisdiction for crypto business registration

- No income or capital gains tax

- Financial Services Authority provides oversight

- ECCB provides regional monetary oversight

- Several crypto exchanges have been registered here