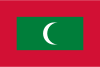

Maldives vs Uruguay

Crypto regulation comparison

Maldives

Uruguay

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Uruguay has a generally favorable stance toward cryptocurrency. The BCU has not banned crypto and in 2024 introduced regulations for virtual asset service providers. Crypto income may be taxed at 12% under the IRPF (personal income tax) as capital income. Uruguay has a stable economy and is positioning itself as a fintech hub in Latin America.

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption

Key Points

- BCU introduced VASP regulations in 2024

- Crypto income taxed at 12% as capital income under IRPF

- Crypto not classified as legal tender; peso remains the national currency

- Uruguay has a relatively stable economy and favorable fintech environment

- AML/KYC requirements apply to registered VASPs