North Macedonia vs Maldives

Crypto regulation comparison

North Macedonia

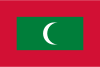

Maldives

North Macedonia has no dedicated cryptocurrency legislation. Crypto is not prohibited and operates in a regulatory gray area. The general flat 10% income tax rate may apply to crypto profits. The government is working toward EU MiCA alignment and plans to license crypto exchanges by 2025-2026.

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Key Points

- No dedicated cryptocurrency legislation

- Central bank has acknowledged crypto without banning it

- General flat 10% personal income tax rate may apply to crypto profits

- Government working toward licensing crypto exchanges by 2025-2026

- Working toward EU candidacy and alignment with MiCA regulation

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption