Monaco vs Nauru

Crypto regulation comparison

Monaco

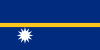

Nauru

Legal

Legal

Monaco has no income or capital gains tax. The CCAF oversees financial activities. Monaco has shown interest in blockchain technology and digital assets.

Nauru has no specific cryptocurrency regulation.

Tax Type

No tax

Tax Type

None

Tax Rate

0%

Tax Rate

N/A

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

Commission de Contrôle des Activités Financières (CCAF)

Regulator

Command Ridge Virtual Asset Authority (CRVAA)

Stablecoin Rules

No specific stablecoin regulation

Stablecoin Rules

No stablecoin regulation

Key Points

- No income or capital gains tax

- CCAF provides financial regulatory oversight

- Government has shown interest in blockchain technology

- Working on digital asset regulatory framework

- Small but active fintech community

Key Points

- No specific cryptocurrency legislation

- Very limited financial infrastructure

- Minimal crypto adoption

- One of the world's smallest economies

- No licensing framework for crypto services