Monaco vs Namibia

Crypto regulation comparison

Monaco

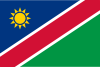

Namibia

Monaco has no income or capital gains tax. The CCAF oversees financial activities. Monaco has shown interest in blockchain technology and digital assets.

Namibia enacted the Virtual Assets Act (Act 10 of 2023) establishing a comprehensive licensing framework for VASPs. The Bank of Namibia is designated as regulator. Crypto is legal but not legal tender. No specific crypto tax framework yet.

Key Points

- No income or capital gains tax

- CCAF provides financial regulatory oversight

- Government has shown interest in blockchain technology

- Working on digital asset regulatory framework

- Small but active fintech community

Key Points

- Virtual Assets Act (Act 10 of 2023) signed into law July 2023

- VASPs must obtain licenses from Bank of Namibia to operate

- Provisional licenses granted to first two exchanges in 2025

- Non-compliance penalties up to NAD 10 million and 10 years imprisonment

- Crypto is not legal tender but merchants may accept at their discretion