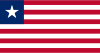

Liberia vs Latvia

Crypto regulation comparison

Liberia

Latvia

The CBL has not issued crypto licenses and considers unauthorized crypto products illegal. No specific crypto legislation exists but the Financial Institutions Act requires licensing for all financial services.

Cryptocurrency is legal in Latvia and regulated under the EU MiCA framework. Since 2023, the financial regulator FKTK merged into Latvijas Banka, which now oversees VASP registration and AML compliance. Capital gains from crypto are taxed at 20%. Latvia has been proactive in implementing EU-wide crypto standards.

Key Points

- CBL has not approved any crypto licensing

- Unauthorized crypto products deemed illegal under Financial Institutions Act

- CBL shut down local crypto startup TACC in 2021

- No specific crypto tax framework

- Very low crypto adoption due to limited internet access

Key Points

- VASPs must register with Latvijas Banka and comply with AML/CFT requirements

- Capital gains from crypto taxed at 20% personal income tax rate

- MiCA framework applies from December 2024, transitioning existing registrations

- Latvia transposed the 5th Anti-Money Laundering Directive for crypto oversight

- Latvijas Banka absorbed FKTK regulatory functions in January 2023