Liechtenstein vs Nauru

Crypto regulation comparison

Liechtenstein

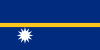

Nauru

Legal

Legal

Liechtenstein's Blockchain Act (TVTG) effective since 2020 is among the world's most comprehensive crypto frameworks. The FMA supervises registered TT service providers. Adapted for EU MiCAR in 2025.

Nauru has no specific cryptocurrency regulation.

Tax Type

Income

Tax Type

None

Tax Rate

1-8%

Tax Rate

N/A

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

Financial Market Authority (FMA)

Regulator

Command Ridge Virtual Asset Authority (CRVAA)

Stablecoin Rules

Regulated under TVTG and MiCAR

Stablecoin Rules

No stablecoin regulation

Key Points

- Blockchain Act (TVTG) adopted unanimously in 2019, effective Jan 2020

- Token Container Model enables tokenization of any asset or right

- FMA registers and supervises all TT service providers

- EEA MiCAR Implementation Act entered into force Feb 2025

- First country with comprehensive blockchain-specific legislation

Key Points

- No specific cryptocurrency legislation

- Very limited financial infrastructure

- Minimal crypto adoption

- One of the world's smallest economies

- No licensing framework for crypto services