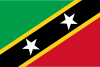

Saint Kitts and Nevis vs Syria

Crypto regulation comparison

Saint Kitts and Nevis

Syria

Saint Kitts and Nevis has taken a crypto-friendly approach. No income or capital gains tax. The country accepts crypto for citizenship by investment.

Syria has a restrictive stance on cryptocurrency compounded by international sanctions. The Central Bank has not authorized crypto activities. International sanctions make access to crypto platforms extremely difficult.

Key Points

- Crypto-friendly regulatory approach

- No income or capital gains tax

- Citizenship by investment accepts cryptocurrency

- ECCB provides regional monetary oversight

- Growing digital economy initiatives

Key Points

- Central Bank has not authorized cryptocurrency activities

- International sanctions severely restrict crypto access

- No specific cryptocurrency legislation

- Limited internet infrastructure hampers crypto use

- Informal crypto usage exists despite restrictions