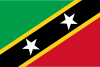

Saint Kitts and Nevis vs El Salvador

Crypto regulation comparison

Saint Kitts and Nevis

El Salvador

Saint Kitts and Nevis has taken a crypto-friendly approach. No income or capital gains tax. The country accepts crypto for citizenship by investment.

El Salvador made history in September 2021 by becoming the first country to adopt Bitcoin as legal tender through the Bitcoin Law. However, under a January 2025 IMF agreement (Decreto 199), El Salvador amended the law to make Bitcoin acceptance by businesses voluntary rather than mandatory, and repealed several articles. There is no capital gains tax on Bitcoin. The CNAD regulates digital assets.

Key Points

- Crypto-friendly regulatory approach

- No income or capital gains tax

- Citizenship by investment accepts cryptocurrency

- ECCB provides regional monetary oversight

- Growing digital economy initiatives

Key Points

- First country to adopt Bitcoin as legal tender in September 2021 via the Bitcoin Law

- Government developed the Chivo wallet for citizens, offering $30 USD in BTC incentive

- January 2025 Decreto 199 made merchant Bitcoin acceptance voluntary (IMF condition)

- No capital gains tax on Bitcoin transactions for individuals

- Government has been accumulating Bitcoin reserves and launched Bitcoin-backed bonds