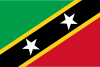

Saint Kitts and Nevis vs North Macedonia

Crypto regulation comparison

Saint Kitts and Nevis

North Macedonia

Saint Kitts and Nevis has taken a crypto-friendly approach. No income or capital gains tax. The country accepts crypto for citizenship by investment.

North Macedonia has no dedicated cryptocurrency legislation. Crypto is not prohibited and operates in a regulatory gray area. The general flat 10% income tax rate may apply to crypto profits. The government is working toward EU MiCA alignment and plans to license crypto exchanges by 2025-2026.

Key Points

- Crypto-friendly regulatory approach

- No income or capital gains tax

- Citizenship by investment accepts cryptocurrency

- ECCB provides regional monetary oversight

- Growing digital economy initiatives

Key Points

- No dedicated cryptocurrency legislation

- Central bank has acknowledged crypto without banning it

- General flat 10% personal income tax rate may apply to crypto profits

- Government working toward licensing crypto exchanges by 2025-2026

- Working toward EU candidacy and alignment with MiCA regulation