Saint Kitts and Nevis vs Liberia

Crypto regulation comparison

Saint Kitts and Nevis

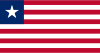

Liberia

Legal

Restricted

Saint Kitts and Nevis has taken a crypto-friendly approach. No income or capital gains tax. The country accepts crypto for citizenship by investment.

The CBL has not issued crypto licenses and considers unauthorized crypto products illegal. No specific crypto legislation exists but the Financial Institutions Act requires licensing for all financial services.

Tax Type

No tax

Tax Type

None

Tax Rate

0%

Tax Rate

N/A

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

Eastern Caribbean Central Bank (ECCB), Financial Services Regulatory Commission

Regulator

Central Bank of Liberia

Stablecoin Rules

No specific stablecoin regulation

Stablecoin Rules

No stablecoin regulation

Key Points

- Crypto-friendly regulatory approach

- No income or capital gains tax

- Citizenship by investment accepts cryptocurrency

- ECCB provides regional monetary oversight

- Growing digital economy initiatives

Key Points

- CBL has not approved any crypto licensing

- Unauthorized crypto products deemed illegal under Financial Institutions Act

- CBL shut down local crypto startup TACC in 2021

- No specific crypto tax framework

- Very low crypto adoption due to limited internet access