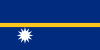

Israel vs Nauru

Crypto regulation comparison

Israel

Nauru

Legal

Legal

Cryptocurrency is legal in Israel and treated as a taxable asset. The Israel Tax Authority classifies crypto as property, subject to 25% capital gains tax (or up to 50% for significant shareholders or high earners). Israel has a vibrant blockchain ecosystem with many startups and R&D centers.

Nauru has no specific cryptocurrency regulation.

Tax Type

Capital gains

Tax Type

None

Tax Rate

25-50%

Tax Rate

N/A

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

ISA (Israel Securities Authority), ITA (Israel Tax Authority), CTMFA

Regulator

Command Ridge Virtual Asset Authority (CRVAA)

Stablecoin Rules

No specific stablecoin regulation; ISA exploring digital asset framework

Stablecoin Rules

No stablecoin regulation

Key Points

- Capital gains tax of 25% on crypto profits (up to 50% including surtax for high earners)

- Israel Tax Authority classifies cryptocurrency as property, not currency

- ISA is developing a regulatory framework for digital asset trading platforms

- AML/KYC requirements apply to crypto service providers under CTMFA supervision

- Israel has one of the highest densities of blockchain startups globally

Key Points

- No specific cryptocurrency legislation

- Very limited financial infrastructure

- Minimal crypto adoption

- One of the world's smallest economies

- No licensing framework for crypto services