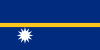

Ireland vs Nauru

Crypto regulation comparison

Ireland

Nauru

Legal

Legal

Cryptocurrency is legal in Ireland and subject to a 33% capital gains tax, one of the higher rates in the EU. The Central Bank of Ireland supervises VASPs under AML regulations, and Ireland follows the EU's MiCA framework. Ireland's status as a European tech hub has attracted crypto businesses.

Nauru has no specific cryptocurrency regulation.

Tax Type

Capital gains

Tax Type

None

Tax Rate

33%

Tax Rate

N/A

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

Central Bank of Ireland, Revenue Commissioners

Regulator

Command Ridge Virtual Asset Authority (CRVAA)

Stablecoin Rules

Regulated under EU MiCA framework

Stablecoin Rules

No stablecoin regulation

Key Points

- 33% capital gains tax on crypto profits (CGT), with an annual exemption of €1,270

- Income from crypto mining, staking, or airdrops may be treated as income tax

- Central Bank of Ireland registers VASPs under the Criminal Justice (Money Laundering) Act

- MiCA framework applicable from December 2024

- Ireland hosts European headquarters of several major crypto firms

Key Points

- No specific cryptocurrency legislation

- Very limited financial infrastructure

- Minimal crypto adoption

- One of the world's smallest economies

- No licensing framework for crypto services