Ireland vs Maldives

Crypto regulation comparison

Ireland

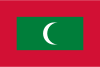

Maldives

Cryptocurrency is legal in Ireland and subject to a 33% capital gains tax, one of the higher rates in the EU. The Central Bank of Ireland supervises VASPs under AML regulations, and Ireland follows the EU's MiCA framework. Ireland's status as a European tech hub has attracted crypto businesses.

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Key Points

- 33% capital gains tax on crypto profits (CGT), with an annual exemption of €1,270

- Income from crypto mining, staking, or airdrops may be treated as income tax

- Central Bank of Ireland registers VASPs under the Criminal Justice (Money Laundering) Act

- MiCA framework applicable from December 2024

- Ireland hosts European headquarters of several major crypto firms

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption