Hungary vs Madagascar

Crypto regulation comparison

Hungary

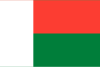

Madagascar

Cryptocurrency is legal in Hungary and subject to a 15% personal income tax on gains. Hungary follows EU regulatory frameworks including MiCA. The MNB supervises crypto service providers, and the country has a growing blockchain and crypto ecosystem.

Madagascar has no specific cryptocurrency regulation. The central bank has not issued formal guidance on crypto. Crypto operates in a legal gray area.

Key Points

- 15% personal income tax on crypto gains

- Additional social contribution tax may apply to certain crypto income

- MNB supervises VASPs for AML/KYC compliance

- MiCA framework applicable from December 2024

- Hungary's tax rate on crypto is competitive within the EU

Key Points

- No specific cryptocurrency legislation

- Central bank has not issued formal crypto guidance

- Crypto not recognized as legal tender

- Limited crypto adoption and infrastructure

- No licensing framework for crypto businesses