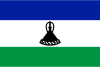

Hungary vs Lesotho

Crypto regulation comparison

Hungary

Lesotho

Legal

No Regulation

Cryptocurrency is legal in Hungary and subject to a 15% personal income tax on gains. Hungary follows EU regulatory frameworks including MiCA. The MNB supervises crypto service providers, and the country has a growing blockchain and crypto ecosystem.

Lesotho has no specific cryptocurrency regulation. The central bank has not issued formal guidance on crypto.

Tax Type

Capital gains

Tax Type

None

Tax Rate

15%

Tax Rate

N/A

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

MNB (Magyar Nemzeti Bank)

Regulator

Central Bank of Lesotho

Stablecoin Rules

Regulated under EU MiCA framework

Stablecoin Rules

No stablecoin regulation

Key Points

- 15% personal income tax on crypto gains

- Additional social contribution tax may apply to certain crypto income

- MNB supervises VASPs for AML/KYC compliance

- MiCA framework applicable from December 2024

- Hungary's tax rate on crypto is competitive within the EU

Key Points

- No specific cryptocurrency legislation

- Central bank has not issued formal crypto guidance

- Part of the Common Monetary Area with South Africa

- Limited crypto adoption

- No licensing framework for crypto services