Egypt vs Saint Kitts and Nevis

Crypto regulation comparison

Egypt

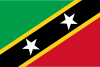

Saint Kitts and Nevis

Egypt heavily restricts cryptocurrency. The Central Bank of Egypt prohibits banks from dealing in or facilitating crypto transactions, and a 2018 Dar al-Ifta fatwa declared crypto trading haram. However, Egypt's 2020 banking law created a framework that could eventually allow regulated crypto under CBE licensing.

Saint Kitts and Nevis has taken a crypto-friendly approach. No income or capital gains tax. The country accepts crypto for citizenship by investment.

Key Points

- CBE prohibits banks and financial institutions from dealing in cryptocurrency

- Dar al-Ifta issued a 2018 religious ruling (fatwa) against crypto trading

- 2020 Central Bank and Banking Sector Law requires CBE approval for any crypto activity

- Creating or operating a crypto platform without CBE license is illegal

- Despite restrictions, Egypt has significant peer-to-peer crypto activity

Key Points

- Crypto-friendly regulatory approach

- No income or capital gains tax

- Citizenship by investment accepts cryptocurrency

- ECCB provides regional monetary oversight

- Growing digital economy initiatives