Cyprus vs Maldives

Crypto regulation comparison

Cyprus

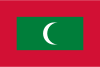

Maldives

Cyprus regulates crypto under the EU MiCA framework (fully applicable since December 2024). CySEC authorizes crypto-asset service providers (CASPs) while the Central Bank of Cyprus oversees e-money tokens and asset-referenced tokens. Crypto gains from occasional transactions are currently not taxed; active trading is taxed as income at 0-35%. A proposed 8% flat tax on crypto gains is pending parliamentary approval for 2026.

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Key Points

- CySEC authorizes and supervises crypto-asset service providers under MiCA

- No capital gains tax on crypto for occasional transactions; active trading taxed as income

- EU MiCA regulation applies as an EU member state

- AML/CFT requirements enforced for all crypto businesses

- Proposed 8% flat tax on crypto gains pending parliamentary approval for 2026

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption