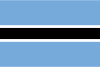

Botswana vs Belize

Crypto regulation comparison

Botswana

Belize

Legal

No Regulation

Botswana passed the Virtual Assets Act in 2022, first African country to issue crypto licenses. NBFIRA supervises VASPs. 4 licensed entities as of 2024. Penalties up to P250,000 or 5 years imprisonment.

Belize has no specific cryptocurrency legislation. The central bank has not banned crypto. No capital gains tax exists in Belize.

Tax Type

None

Tax Type

No tax

Tax Rate

N/A

Tax Rate

0%

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

Regulator

Central Bank of Belize

Stablecoin Rules

No stablecoin regulation

Stablecoin Rules

No stablecoin regulation

Key Points

- Virtual Assets Act enacted in 2022, effective Feb 22, 2022

- First African country to issue crypto licenses via NBFIRA

- 4 licensed VASPs as of December 2024

- Bank of Botswana assesses domestic crypto risks as minimal

- Unregistered crypto dealers face fines up to P250,000 or imprisonment

Key Points

- No specific cryptocurrency legislation

- Central bank has not banned crypto

- No capital gains tax in Belize

- Limited crypto adoption and infrastructure

- No licensing framework for crypto businesses