Brazil vs Maldives

Crypto regulation comparison

Brazil

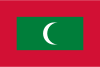

Maldives

Brazil passed comprehensive crypto legislation (Law 14,478) in December 2022, which took effect in June 2023. The Banco Central do Brasil was designated as the primary regulator for crypto assets used as payment, while the CVM oversees crypto securities. Capital gains on crypto are taxed at 15-22.5%.

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Key Points

- Law 14,478/2022 (Marco Legal das Criptomoedas) provides a comprehensive legal framework

- Banco Central regulates VASPs; exchanges must obtain authorization to operate

- Capital gains taxed at 15% (up to R$5M), 17.5% (R$5-10M), 20% (R$10-30M), 22.5% (above R$30M)

- Monthly gains under R$35,000 from sales on domestic exchanges are exempt

- Receita Federal requires detailed monthly reporting of crypto transactions via IN1888

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption