Benin vs Bahamas

Crypto regulation comparison

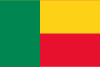

Benin

Bahamas

Benin has no specific cryptocurrency regulation. As a WAEMU member, it falls under BCEAO oversight. The BCEAO has warned against crypto but there is no formal ban.

The Bahamas enacted the Digital Assets and Registered Exchanges (DARE) Act in 2020, creating a comprehensive regulatory framework. The SCB oversees digital asset businesses. The Bahamas also launched the Sand Dollar CBDC.

Key Points

- No specific national cryptocurrency legislation

- BCEAO provides regional monetary and regulatory oversight

- Part of the WAEMU monetary zone using the CFA franc

- Limited crypto adoption

- No licensing framework for crypto businesses

Key Points

- DARE Act (2020) provides comprehensive regulation for digital assets and exchanges

- Securities Commission of the Bahamas licenses and supervises digital asset businesses

- No income tax, capital gains tax, or crypto-specific taxes

- Sand Dollar CBDC launched in 2020 as one of the world's first

- FTX collapse in 2022 led to enhanced scrutiny and regulatory updates