Austria vs Panama

Crypto regulation comparison

Austria

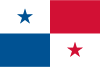

Panama

Cryptocurrency is legal in Austria and regulated under the EU's MiCA framework. Since March 2022, crypto assets are taxed at a flat 27.5% rate on capital gains, aligned with other investment income. The FMA supervises crypto service providers.

Panama passed Law 129 in 2024 regulating crypto assets, virtual asset service providers, and tokenized securities. Panama has no capital gains tax on foreign-sourced or investment income, making it attractive for crypto investors. The law provides a regulatory framework for exchanges and establishes AML/KYC obligations for VASPs.

Key Points

- Flat 27.5% tax on crypto capital gains since the 2022 eco-social tax reform

- Crypto held before February 28, 2021 is subject to legacy rules (tax-free after 1 year)

- FMA regulates VASPs under Austrian and EU law including MiCA

- Exchanges must register and comply with AML/KYC obligations under FM-GwG

- MiCA framework fully applicable from December 2024

Key Points

- Law 129 (2024) regulates crypto assets and VASPs in Panama

- No capital gains tax on investment or foreign-sourced income (territorial tax system)

- VASPs must comply with AML/KYC requirements under the new framework

- Crypto payments for commercial transactions are permitted

- Panama's territorial tax system means crypto gains from international trading are untaxed