Argentina vs Saint Kitts and Nevis

Crypto regulation comparison

Argentina

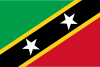

Saint Kitts and Nevis

Cryptocurrency is legal in Argentina and widely adopted due to persistent inflation and currency controls. The CNV regulates crypto service providers under a 2024 registration framework. Argentina has one of the highest crypto adoption rates globally, with stablecoins used as a hedge against peso devaluation.

Saint Kitts and Nevis has taken a crypto-friendly approach. No income or capital gains tax. The country accepts crypto for citizenship by investment.

Key Points

- CNV registered as the regulatory authority for virtual asset service providers (VASPs) under FATF guidelines

- Crypto gains taxed as income under the income tax law at progressive rates

- High adoption driven by inflation and capital controls on the Argentine peso

- Exchanges must register with the CNV and comply with AML/KYC requirements

- No legal tender status for crypto; the peso remains the only legal tender

Key Points

- Crypto-friendly regulatory approach

- No income or capital gains tax

- Citizenship by investment accepts cryptocurrency

- ECCB provides regional monetary oversight

- Growing digital economy initiatives