Armenia vs Maldives

Crypto regulation comparison

Armenia

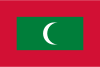

Maldives

Armenia adopted a comprehensive Law on Crypto Assets in May 2025, effective July 2025, modeled on the EU's MiCA. The Central Bank of Armenia licenses crypto service providers. Non-entrepreneur crypto gains are tax-free (0%); ECOS Free Economic Zone offers incentives for blockchain startups. Licensing enforcement begins January 2026.

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Key Points

- Law on Crypto Assets adopted May 2025, effective July 2025

- Central Bank of Armenia licenses all crypto service providers

- 0% capital gains tax for non-entrepreneur crypto transactions

- Framework modeled on EU MiCA regulation

- Licensing enforcement begins January 31, 2026

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption