Antigua and Barbuda vs Maldives

Crypto regulation comparison

Antigua and Barbuda

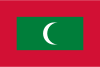

Maldives

Legal

Restricted

Antigua and Barbuda has introduced legislation for digital assets. No income or capital gains tax applies.

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Tax Type

No tax

Tax Type

None

Tax Rate

0%

Tax Rate

N/A

Exchanges

Yes

Exchanges

No

Mining

Yes

Mining

No

Regulator

Eastern Caribbean Central Bank (ECCB), Financial Services Regulatory Commission

Regulator

Maldives Monetary Authority (MMA)

Stablecoin Rules

No specific stablecoin regulation

Stablecoin Rules

No stablecoin regulation

Key Points

- Digital asset business legislation enacted

- No income or capital gains tax

- ECCB provides regional monetary oversight

- Government has promoted crypto-friendly policies

- Citizenship by investment program accepts crypto

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption