Uphold Exchange

Exchange Fees

Deposit Methods

Cryptos (206)

DISCLAIMER: Terms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Currently blocked user sign-ups in the following countries: Argentina, Brazil, Dominican Republic, Ecuador, Mexico, Morocco, Nepal, Nigeria, Pakistan, Panama, Paraguay, Peru, Philippines, South Africa, Sri Lanka, Thailand, Turkey, Uzbekistan.

Uphold Exchange Review

What is Uphold Exchange?

Uphold Exchange is a cryptocurrency exchange from the United States, that also has offices in London. It has been active in the crypto industry since 2013.

Comparison With Other Platforms

On its website, Uphold presents a comparison between its own platform, Coinbase, Revolut and Robinhood. "National" currencies below means fiat currencies, i.e. state-issued currencies such as the USD, EUR and GBP. "Digital" means cryptocurrencies. Looking at the below comparison table, Uphold surely look like a strong competitor to Coinbase and the others.

Another unique feature of Uphold that separates it from its peers in the industry is the 100% fully reserved feature. Uphold doesn't loan user funds which makes it more resilient during volatile market conditions. Under such conditions, users are less likely to face withdrawal restrictions.

Supported Cryptocurrencies / Fiat Currencies

Uphold Exchange offers trading in a large number of cryptocurrencies (150+ different ones), so you can definitely buy and sell the really big ones here but also many more exotic altcoins.

There are of course two sides of the same coin here. On a positive note, a large number of supported cryptos means that even the most exotic altcoin trader can stay at this platform and will not have to look elsewhere to cater for all his/her specific trading needs. On the flip side, however, this might also mean that there could be more dubious coins available for trading as well. Exchanges with a smaller number of supported cryptos generally only support the bigger crypto projects, which have all been subject to numerous due diligence processes and that are – in most cases – properly vetted. A newly launched altcoin has not been subject to the same scrutiny.

Mobile Support

Most crypto traders feel that desktop give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that Uphold Exchange’s trading platform is also mobile compatible. You can download it from both the AppStore and Google Play.

US-investors

According to information we have received, US-investors are indeed permitted to trade at Uphold Exchange. Any US-investors should however also form their own opinion on this, as various state rules could also be an obstacle in their cryptocurrency trading.

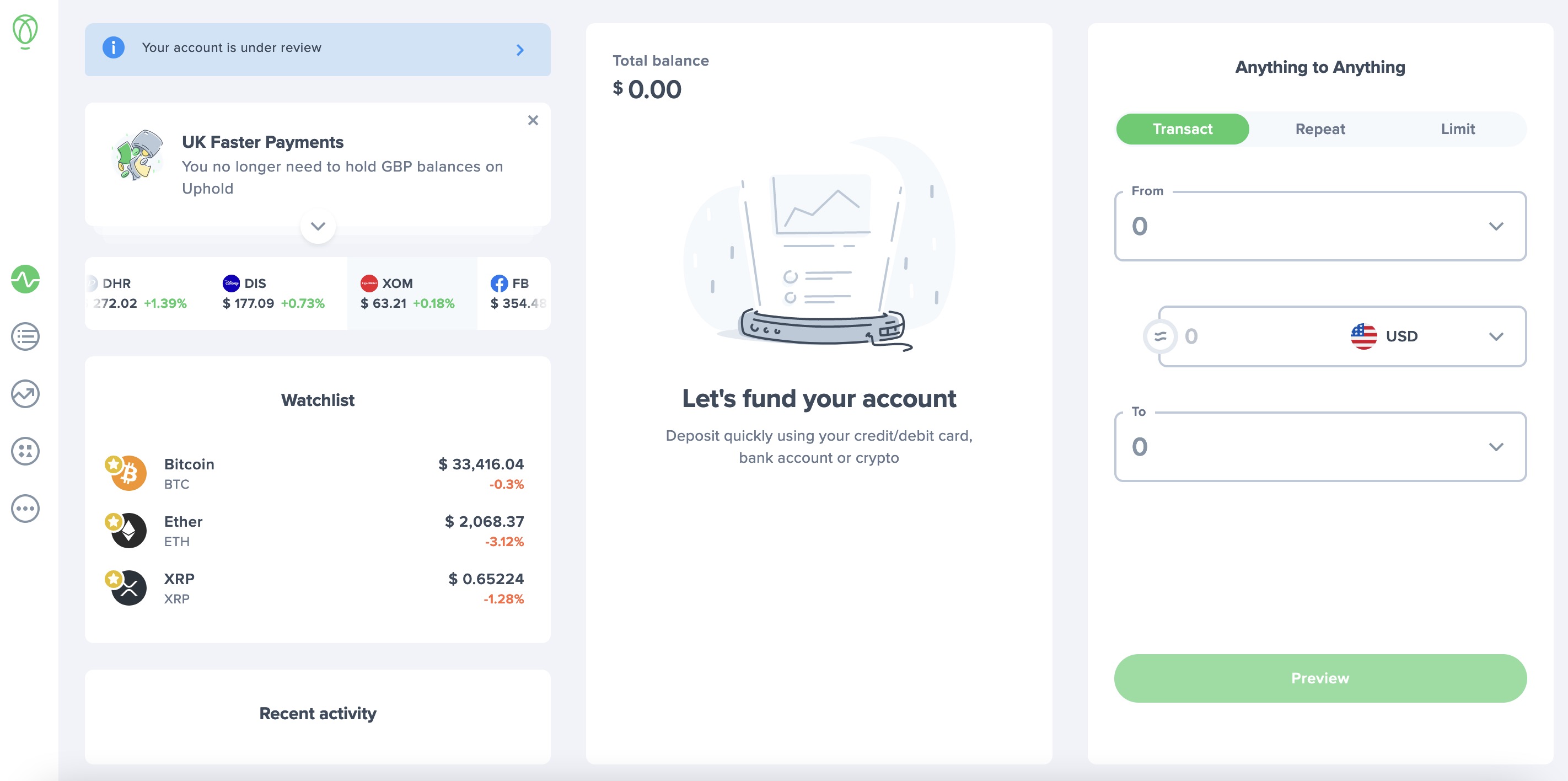

Uphold Exchange Trading View

Every trading platform has a trading view. The trading view is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same view on your desktop. There are of course also variations to what we have now described.

Uphold Exchange's purchase interface gives you the option to insert the exact amount of USD, EUR or whatever fiat currency you prefer, that you wish to spend or the amount of BTC (or whichever other cryptocurrency you are interested in) that you wish to buy. This purchase interface makes it very easy to understand if you’re new to crypto, yet it might not offer all the advanced buy/sell features more experienced traders look for. Here’s a peek at Uphold Exchange's interface in desk top format:

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

Uphold Exchange Fees

Uphold Exchange Trading Fees

When you buy cryptocurrency at Uphold Exchange, you have to pay trading fees. However, the trading fees differ in their structure compared to the trading fees at many other centralized crypto exchanges for instance. At Uphold Exchange, just like at most Crypto CFD-platforms, you pay something called "spreads".

Let’s start with explaining what a “spread” is. In essence, the spread can be compared to trading fees at centralized crypto exchanges. It is the mark-up or mark-down charged by the platform when you purchase a certain crypto. So if the price of the relevant cryptocurrency is USD 100, and the spread is 1%, the buyer can buy the crypto on the trading platform for USD 101 (or sell it for USD 99). The difference between the sell price and the purchase price (USD 1 in this case), goes to the trading platform.

Uphold Exchange has different spreads for different trading pairs, and they don't guarantee that a certain trade will always result in the same spread. Instead, they state the following:

"In the U.S. and Europe, our spread is typically 0.8 to 1.2% on BTC and ETH.

-

- In other parts of the world, our spread on the majors is typically around 1.8%.

- Spreads can be significantly higher for low-liquidity cryptos and tokens including XRP, ZIL, OXT, UPT, DOGE and others. Check rates at Preview before you trade.

- Coordinated market activity such as Wall St Bets can distort markets. All the above spreads are likely to widen beyond those above during times of acute market stress."

We have chosen to include 1.20% as the trading fee for Uphold Exchange. Compared to Cryptowisser.com's latest empirical study, the industry average spot trading taker fees were 0.2294% and the corresponding spot trading maker fees were 0.1854%. Both 0.80% (the low end of Uphold's own spread estimates) and 1.20% (the corresponding high end) are substantially above the foregoing industry averages.

Uphold Exchange Withdrawal Fees

Withdrawal fees are usually fixed and vary from crypto-to-crypto. If you withdraw BTC, you pay a small amount of BTC for the withdrawal. If you withdraw ETH, you pay ETH. The last time we did an empirical study of the BTC-withdrawal fees in the crypto exchange market, we found that the average BTC-withdrawal fee was 0.0004599 BTC per BTC-withdrawal (for more info on the report, click here).

Uphold Exchange charges USD 2.99 for withdrawals. When converting USD 2.99 to BTC on the date of last updating this review (23 January 2023), the result was 0.00013 BTC, so Uphold Exchange's withdrawal fee offering is substantially below the global industry average BTC-withdrawal fee as mentioned above.

Deposit Methods

In addition to depositing cryptocurrency to the platform, Uphold Exchange also lets you deposit fiat currency. It allows deposits through wire transfer, credit or debit cards and has recently introduced deposits via Google Pay. The minimum deposit through Google Pay is USD 10 and the maximum deposit per day is capped at USD 500. This fiat currency on-ramp makes Uphold Exchange an easy place to start trading at for the new cryptocurrency traders out there - a so-called "entry-level exchange".

DISCLAIMER: You should be aware that the risk of loss in trading or holding cryptoassets can be very high. As with any asset, the value of cryptoassets can go up or down and there can be a substantial risk that you lose all your money buying, selling, holding or investing in cryptoassets. Your cryptoassets are not subject to protection. You should carefully consider whether trading or holding cryptoassets is suitable for you in light of your financial condition. Uphold makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about Uphold.

FAQs

Are Uphold's fees high?

Yes, Uphold's fees are high. At Uphold, they charge "spreads" rather than typical spot trading fees, but their spreads are between 0.80-1.20%, while the typical spot trading fee range is more like 0.10-0.20%.

What is the minimum deposit on Uphold?

The minimum deposit at Uphold varies dependent upon how you deposit. Some deposits (such as crypto asset deposits) do not have any minimum limits. Other deposits, such as debit or credit card payment, has a minimum deposit of USD 10.

How long is the withdrawal time at Uphold?

We have not been able to find any recent information on crypto withdrawal times at Uphold, only fiat currency withdrawals. Fiat currency withdrawals take on average 4 days according to Uphold.

Has Uphold ever been hacked?

As of the date of writing this text, 16 February 2023, Uphold Exchange or Uphold Wallet has to our knowledge never been hacked. Their mail service was hacked once though, back in November 2018.

Is Uphold secure?

We have no reason to question the security at Uphold. Accordingly, we view it as a secure platform.

Where is Uphold based?

Uphold is based in New York (USA), but it also has offices in London.

Which countries are restricted from using Uphold?

According to Uphold's Membership Agreement, users from the following countries are not allowed to open an account with the platform: Cuba, the Democratic Republic of Congo, Iran, Iraq, Myanmar, North Korea, South Sudan, Sudan, Syria Yemen or any other country subject to US embargo.