Liquid

Exchange Fees

Deposit Methods

Cryptos (57)

UPDATE 7 January 2023: As you might know, FTX filed for bankruptcy on 11 November 2022, after its famous liquidity crisis. Before that, in March 2022, FTX had acquired, inter alia, the Liquid.com platform. The effect of the foregoing is that Liquid.com has now also been swept up in the FTX explosion. Liquid.com has stated the following on their platform today:

Dear Customers,

We have just been instructed by S&C, who act for FTX Trading, to pause all forms of trading on our exchange because of the operation of the Chapter 11 process in the Delaware Courts.

We have since done so while we assess the situation. We are working through these issues and will endeavor to give a fuller update in due course.

Accordingly, we have marked the platform as "dead" in our Exchange Graveyard. We will reactivate it again if it comes back to life.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

Liquid Review

What is Liquid?

Liquid is a crypto exchange that launched in January 2014. It has offices in Singapore but is actually regulated and licensed by the Japanese FSA (Financial Supervisory Authority). The platform offers trading in a decent number of cryptos (174 different trading pairs at the date of first writing this review, 20 December 2018).

Its subsidiary QUOINE Corporation is also (as of 26 October 2021) registered as a Type 1 Financial Instruments Business in Japan. Following such registration, they will now expand its cryptocurrency derivative trading services for Japanese users.

Mobile Support

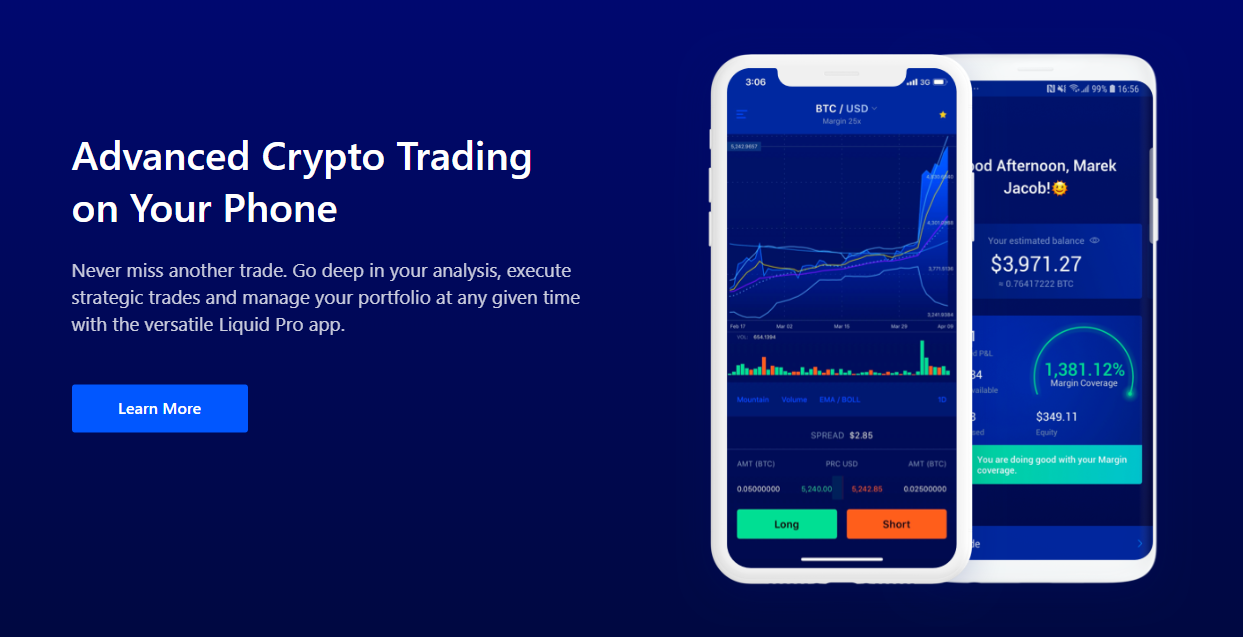

Do you like to monitor your cryptocurrency investments, and even do some trading, while on your phone? If so, this exchange has an app for you: Liquid Pro App. With this app, you can use most features of the trading platform and won’t even need a desktop at all!

Liquidity

On the date of last updating this review (2 December 2021) the 24-hour trading volume was USD 188 million, according to Coinmarketcap.com.

US-investors

US-investors may only trade crypto-to-crypto (and not fiat-to-crypto) here. The primary reason for excluding US-investors from fiat-to-crypto trading is legal. The US-legal regime imposes obligations on many companies accepting funds from US-investors. Such obligations include, inter alia, preparing marketing material in accordance with SEC-standards and registering them with the SEC (a burdensome process). If you’re a US-investor looking for a platform where you can trade fiat-to-crypto, use our Exchange Filters to find out which alternatives you have.

Liquid Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the somewhat limited trading view at Liquid:

Liquid Fees

Liquid Trading fees

When looking at trading fees at a cryptocurrency exchange, you must first understand the concept of “maker” and “taker”. Every trade occurs between these two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. We call makers “makers” because their orders make the liquidity in a market. Takers are the ones who remove this liquidity by matching makers’ orders with their own.

Liquid has an interesting fee offering. Takers 0.30% in trading fees (or 0.15% if you pay the trading fees in QASH). As the global industry average is around 0.25%, Liquid’s fees is just slightly above the industry average.

However, this exchange does not charge any fees for makers, thus promoting the liquidity at the exchange. This is a very strong part of Liquid's offering and can be really helpful for people interested in not picking up existing orders from the orderbook.

Trading fees are also reduced as the preceding 30-day trading volume reaches certain thresholds, as follows:

Liquid Withdrawal fees

Most exchanges charge a fixed withdrawal fee when you withdraw crypto from the exchange. Liquid too. They charge a withdrawal fee amounting to 0.0005 BTC when you withdraw BTC. This fee is quite in line with the current industry average (which is around 0.00053 BTC according to this report).

Deposit Methods

Liquid offers wire transfer as a deposit method, but you can’t deposit via credit card. According to information from Liquid to us here at Cryptowisser, credit card funding will be available also at this trading platform sometime during January-March 2019. So if you need to deposit fiat currency via credit card but there is no urgent need to do it, Liquid might still be the right place for you.

A concluding note to make here is that Liquid is among the first (if not the first) crypto exchange to enable FIO deposit addresses. If you deposit crypto to an exchange, you normally need to input a long series of letters and numbers, and it is easy to input something wrong. There are a lot of stories about people sending large amounts of crypto to the wrong address simply because they mistyped one letter or digit in their 40+-character deposit address. Well, if you're at Liquid, that will hopefully not happen anymore! A FIO deposit address is like a regular email-address: [email protected]. From 13 January 2021, you can register these types of addresses as deposit addresses at Liquid. Very convenient in our opinion.