Changelly Pro

Börsen-Gebühren

Einzahlungsmethoden

Unterstützte Krypto-Währungen (245)

Changelly Pro Review

What is Changelly Pro?

Changelly Pro is a cryptocurrency exchange registered in the Seychelles that has been active since 2020. Changelly Pro is the "pro version" of the regular Changelly platform. Different from the standard Changelly platform, Changelly Pro is an actual centralized exchange platform.

The regular Changelly platform is a non-custodial crypto exchange service. This means that you can use the regular Changelly platform to purchase cryptos from another exchange. Changelly provides you with a window into other exchanges (Binance, Bittrex, Poloniex and HitBTC), all so that they can provide the best price for you.

Changelly Pro Advantages

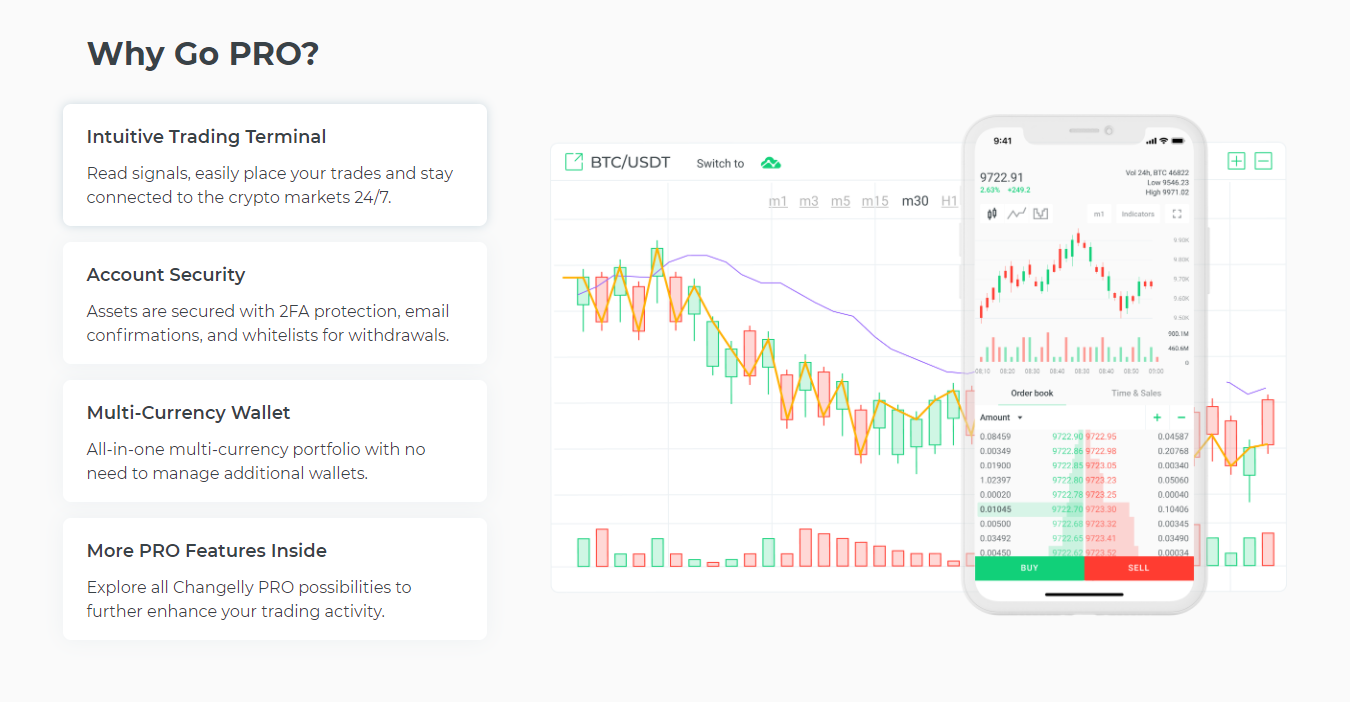

It promotes four things as main advantages with the platform: the intuitive trading terminal, their rigorous account security, the ancillary wallet that can hold a number of different cryptos, and all of its advanced "PRO Features". These all seem to be helpful tools for crypto trading in our book.

Trading Pairs

Changelly Pro - like its big brother Changelly - has a large number of different trading pairs. Many of the more exotic altcoins are supported here as well. There are of course "two sides of the same coin" here. On a positive note, a large number of supported cryptos means that even the most exotic altcoin trader can stay at this platform and will not have to look elsewhere to cater for all his/her specific trading needs. On the flip side, however, this might also mean that there could be scam coins available for trading here, unbeknown to the platform. Exchanges with a smaller number of supported cryptos generally only support the bigger crypto projects, which have all been subject to numerous due diligence processes and that are – in most cases – properly vetted. A more recently launched altcoin has not been subject to the same scrutiny.

Leveraged Trading

Changelly Pro allows you to trade with leverage. This means that you can receive a higher exposure towards a certain crypto’s price increase or decrease, without actually holding the necessary amount of assets. You do this by “leveraging” your trade. In simple terms, this means that you borrow from the exchange to bet more. You can get as much as 50x leverage on this platform.

For instance, let’s say that you have 100 USD in your trading account and you bet this amount on BTC going long (i.e., going up in value). If BTC then increases in value with 10%, you would have earned 10 USD. If you had used 100x leverage, your initial 100 USD position becomes a 10,000 USD position so you instead earn an extra 1,000 USD (990 USD more than if you had not leveraged your deal). However, the more leverage you use, the smaller the distance to your liquidation price becomes. This means that if the price of BTC moves in the opposite direction (goes down for this example), then it only needs to go down a very small percentage for you to lose the entire 100 USD you started with. Again, the more leverage you use, the smaller the opposite price movement needs to be for you to lose your investment. So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

Changelly Pro Trading View

Every trading platform has a trading view. The trading view is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same view on your desktop. There are of course also variations to what we have now described. This is the trading view at Changelly Pro:

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors, unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

According to information from the exchange, US-investors are not permitted to trade here. If you're from the US and want to find an exchange where you can trade, just use our Exchange Filters and we'll help you.

Changelly Pro Fees

Changelly Pro Trading fees

Every time you place an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. Normally, exchanges distinguishes between takers and makers. Takers are the one who “take” an existing order from the order book. Makers are the ones who add orders to the order book, thereby making liquidity at the platform.

At Changelly Pro, the standard trading fees are 0.10% for takers and the same (i.e., no discount) for makers. 0.10% is in line with, or even slightly below, the global industry averages for centralized exchanges. Industry averages have historically been around 0.20-0.25% but we now see new industry averages emerging around 0.10%-0.15%.

However, the fees charged by Changelly Pro vary significantly depending on your trading volume at the platform during the preceding 30-day period. The following trading fee discount table shows how much you have to trade in order to achieve certain trading fee discounts. The trading fees go as low as 0.03% for takers and 0.00% for makers, although we doubt that there are that many traders out there that are able to reach the required 30-day trading volume. On the date of first writing this review (8 February 2021), the trading fee discount table looked as follows:

Changelly Pro Withdrawal fees

Changelly Pro charges a withdrawal fee of 0.0004 BTC per BTC-withdrawal. This fee is a bit below the global industry average. The current global industry average is 0.000643 BTC per BTC-withdrawal according to this report.

Deposit Methods

Changelly Pro lets you deposit assets to the exchange in many different ways, through wire transfer, debit card, and of course also by just depositing existing cryptocurrency assets.

Seeing as fiat currency deposits are possible at this trading platform, Changelly Pro qualifies as an “entry-level exchange”, meaning an exchange where new crypto investors can start their journey into the exciting crypto world.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!