Bitop

Exchange Fees

Deposit Methods

Cryptos (280)

Bitop Review

What is Bitop?

Bitop Exchange is a digital financial service platform. It offers a secure and comfortable environment for digital asset investment worldwide. Users can trade various products, including cryptocurrencies, futures, US stocks, and binary options. You can find popular products like Bitcoin, Ethereum, Ripple, Crude oil, gold, Dax, Silver, Amazon, Apple, Tesla, and Netflix on Bitop Exchange.

The core team consists of experts from traditional financial securities and top internet companies like Microsoft. They have extensive experience in financial transactions, cryptocurrency trading platform research and development, and global market operations. Bitop has gained over 100,000 users from more than 80 countries and regions since 2018, mainly from North America, Europe, and the Asia Pacific.

Derivatives Trading

Bitop exchange offers digital assets and derivatives trading services. A derivative is an instrument that is priced based on the value of an underlying asset. This asset could be stocks, bonds and other interest-bearing securities, commodities etc. However, when talking about the digital asset domain, derivatives rely on the price of their underlying cryptocurrency. You can engage in derivatives trading connected to Bitcoin, Ethereum, Litecoin, Ripple, Binance Coin and Bitcoin Cash here.

Additionally, this platform also supports spot trading. So, if this is your preferred mode of trading, this platform can still be for you.

Different Order Types

Bitop platform offers take-profit and stop-loss features to its traders. The margin ratio for take-profit is 300% whereas the stop-loss margin ratio is at 80%.

Copy Trade Function

Bitop's copy trading function is a powerful tool that benefits new and less experienced traders. It allows traders of all levels to connect, share knowledge, and succeed in cryptocurrency trading.

Users can replicate successful traders' trading actions using their own funds. Online trading is integrated with social media, allowing users to align their trades with seasoned individuals who have a proven track record of profitability and activity. Bitop's copy trading function is an excellent opportunity for beginners or those lacking expertise to learn and profit from experienced traders' strategies.

The copy trading process is easy and seamless. The leaderboard ranks the top traders using key metrics such as 30-day ROR, 30-day win rate, trade days, and cumulative followers. Detailed 30-day activity graphs display the trader's performance, and users can review their history, including the assets and trading pairs they have used. This level of transparency allows users to make informed decisions when choosing traders to follow and replicate.

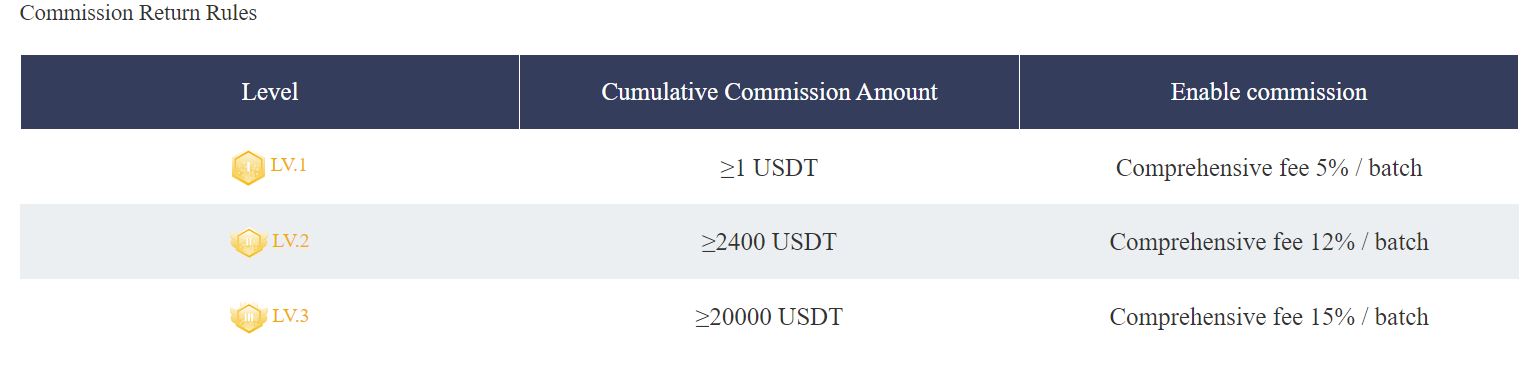

Affiliate Program

Many exchanges launch an affiliate program with the intent to grow their userbase. Bitop too has an affiliate program. As an affiliate, one can earn a certain portion of their referred user’s transaction fee as commission. The portal follows a tiered rebate ratio for its affiliates and the cap limit is fixed at 15%.

Affiliates receive these rebates in their trading account as soon as transaction settlement takes place.

You can sign up for the affiliate program here.

Leveraged Trading

Since the portal offers contract trading with a focus on CFD (Contract for Differences), Bitop users can make leveraged trades. Currently, the platform only hosts futures with expiry dates and offers a leverage of 200x. A word of caution might be useful for someone contemplating leveraged trading. Leveraged trading can lead to massive returns but – on the contrary – also to equally massive losses.

For instance, let’s say that you have 100 USD in your trading account and you bet this amount on BTC going long (i.e., going up in value). If BTC then increases in value by 10%, you would have earned 10 USD. If you had used 100x leverage, your initial 100 USD position becomes a 10,000 USD position so you instead earn an extra 1,000 USD (990 USD more than if you had not leveraged your deal). However, the more leverage you use, the smaller the distance to your liquidation price becomes. This means that if the price of BTC moves in the opposite direction (goes down for this example), then it only needs to go down a very small percentage for you to lose the entire 100 USD you started with. Again, the more leverage you use, the smaller the opposite price movement needs to be for you to lose your investment. So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk-free profits).

Mobile Support

Most crypto traders feel that desktops give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that Bitops’s trading platform is also available as an app for iPhone and Android users.

US-investors

The Bitop Terms of Service clearly outlines certain eligibility criteria for registering on their platform. Failure to meet these criteria could lead to suspension or termination of user qualification.

Clause 2.1.2 mandates that the user must be “a natural person with full capacity for civil conduct prescribed by the laws of the People's Republic of China”.

The second condition, prescribed in Clause 2.1.3, requires the user to hold “a personal debit card account opened and validly held in a commercial bank within the territory of the People's Republic of China (excluding Hong Kong, Macao and Taiwan).”

So, if you’re from the US and would like to engage in crypto trading on Bitop, you will have to fulfil both these conditions. Overall, we are of the opinion that US investors are not allowed on this exchange.

Luckily for you, if you go to the Exchange List and use our exchange filters, you can sort the exchanges based on whether or not they accept US investors.

Bitop Trading Interface

Every trading platform has a trading interface. This interface is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what is its current price. There are normally buy and sell boxes too, where you can place orders with respect to the relevant crypto. In most of the platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same window on your desktop. Of course, there are also variations to what we have just described.

This is the spot trading interface at Bitop (without signing in though):

It is up to you – and only you – to decide if the above trading view is suitable for you. Finally, there are usually many different ways in which you can change the settings to customize the trading interface based on your own preferences.

Bitop Fees

Bitop Trading fees

When evaluating an exchange, it's important to consider the fee structure. Bitop's trading fees are fair and reasonable compared to other exchanges like Huobi, Bybit, and Bitget. Let's take a closer look at the fees:

- For spot trading, both maker and taker fees are set at 0.1%, which is competitive.

- For crypto, transaction fees are based on margin and leverage, ranging between 0.12% to 0.16%.

- For futures, transaction fees start from 0.01%, making it a cost-effective option for futures trading.

- For stocks, transaction fees are set at 0.16%, which is attractive in the realm of stock trading.

Bitop offers incentives for traders through its bonus program. Traders can receive bonuses as rewards, which can be used to deduct up to 50% of their trading transaction fees. This allows traders to effectively reduce their trading costs and enhance their overall trading experience.

Bitop Withdrawal fees

Bitop offers attractive minimum deposits and withdrawals for retail-level traders. The specific amounts may vary depending on the cryptocurrency and network used, but they generally provide convenient options for users. USDT withdrawals, for example, can be as low as $10 worth of USDT via TRC20 blockchain, which is accessible for traders who prefer smaller transactions. On the deposit side, Bitop allows users to start with as little as $15 worth of their desired cryptocurrency, offering great flexibility.

Traders appreciate the user-friendly minimum deposit and withdrawal options. It allows them to efficiently manage their funds and participate in the platform's diverse trading options without facing significant entry barriers.

Deposit Methods

Bitop does not accept wire transfers or credit card payments. So, in order to trade here, you must have cryptocurrency, to begin with. The only asset class you can deposit to Bitop is cryptocurrency.

However, if you really like Bitop but you don’t have any crypto yet, you can easily start an account with an exchange that has “fiat on-ramps” (an exchange where you can deposit regular cash), buy crypto there, and then transfer it from such exchange to this exchange. You can also use our Exchange Filters to easily see which platforms allow wire transfer or credit card deposits.