Birake

Exchange Fees

Deposit Methods

Cryptos (12)

Birake Review

What is Birake?

Birake is a decentralized exchange (DEX) that launched in 2018.

Trading Volume

The trading volume at this platform is quite low. On the date of first writing this review (16 October 2019), Birake’s 24 hour trading volume was only USD 215,000. On the date of last updating this review (2 December 2021), the trading volume was USD 1.1 million according to Coinmarketcap. Although the liquidity is fairly decent, there is still a lot of room for improvement here.

White Label Crypto Exchange Trading Platform

Birake seems to focus on being a “White Label Crypto Exchange Trading Platform”, meaning that other companies can use Birake’s platform and market it as their own. For a price, of course. For the time being, the following exchanges are apparently using Birake’s White Label Solution:

Birake Advantages

Birake markets the following six factors as advantages with their platform:

US-investors

As far as we can tell, US-investors can trade at this trading platform. But, US-investors should always try to research themselves whether they may or may not trade at various crypto exchanges. Sometimes, state laws stand in the way for certain US-investors’ international crypto trading.

General Information on DEXs

DEXs are becoming increasingly more popular, mostly due to the following factors:

- They do not require a third party to store your funds, instead, you are always directly in control of your coins and you transact directly with whoever wants to buy or sell your coins.

- They normally do not require you to give out personal info. This makes it possible to create an account and right away be able to start trading.

- Their servers spread out across the globe leading to a lower risk of server downtime.

- They are essentially immune to hacker attacks.

However, DEXs normally have an order book with lower liquidity than their centralized counterparts and if you lose your password, it is probably lost forever.

But, as mentioned above, they are definitely gaining market shares against their centralized counterparts.

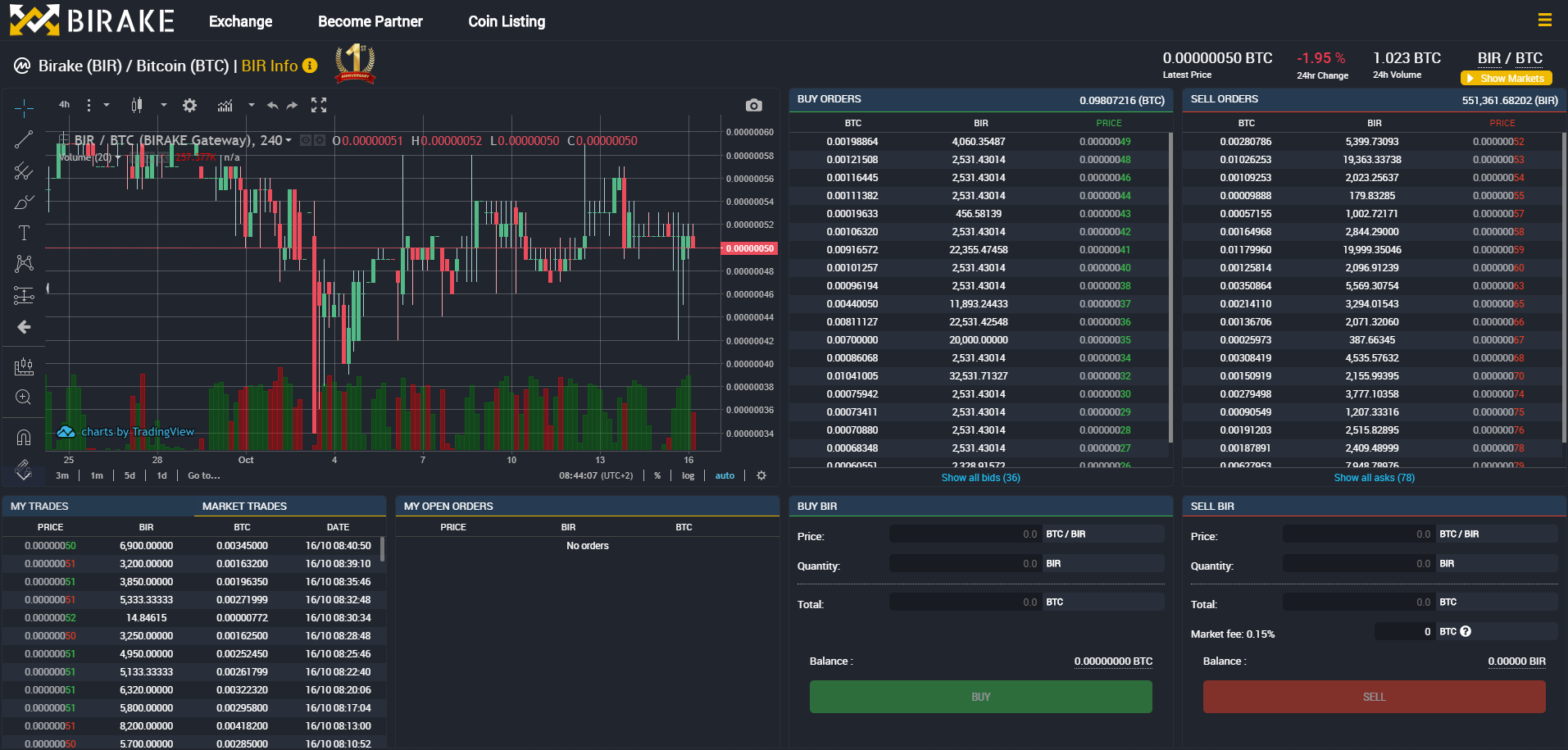

Birake Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen crypto and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can see that it feels right to you. This is the trading view at Birake:

Birake Fees

Birake Trading fees

We have not been able to find any info on this exchange’s trading fees. This is potentially a risk for you as an investor (if you do not receive info on the fees anywhere, there is a higher risk that they are high). Accordingly, we strongly urge you to make your own analysis of fees at this exchange before depositing any funds here.

Birake Withdrawal fees

We have not been able to find any info on this exchange’s withdrawal fees either. The same warning as we made above under Birake Trading fees is made also with respect to the withdrawal fees.

Deposit Methods

You can, as of May 2024, deposit fiat currency to Birake through both wire transfer and credit cards. A very helpful feature indeed!

Birake Security

The servers of DEXs spread out across the globe. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that DEXs are virtually immune to attacks. This is because if you take out one of the servers, it has little to no impact on the full network of servers. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a DEX, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange until you withdraw them to your private wallet. A centralized exchange can therefore be hacked and your funds held at such exchange can be stolen. This is not the case with respect to decentralized exchanges.