BBX

Börsen-Gebühren

Einzahlungsmethoden

Unterstützte Krypto-Währungen (14)

UPDATE 15 July 2021: When trying to access the website of BBX (bbx.com) today, we were unsuccessful. There have been no preceding messages on system maintenance or new domain or anything similar.

Accordingly, we believe that this exchange has closed down and we have marked it as "dead" in our Exchange Graveyard. If the exchange would become active again and the error is just temporary, we will "revive" it and bring it back to our Exchange List.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

BBX Review

BBX is an exchange registered in Malta that launched in April 2018. It currently markets itself as the “world’s leading cryptocurrency index contract trading platform”.

Malta is together with Estonia and Gibraltar one of the few countries in Europe that has developed explicit license requirements for cryptocurrency exchanges. When Malta issued specific license requirements for cryptocurrency exchanges, a lot of exchanges from other parts of the world actually relocated to Malta. Changelly, ZBX, Coindeal, Bleutrade, Graviex, Coinall and The Rock Trading are today all based in Malta.

Mobile Support

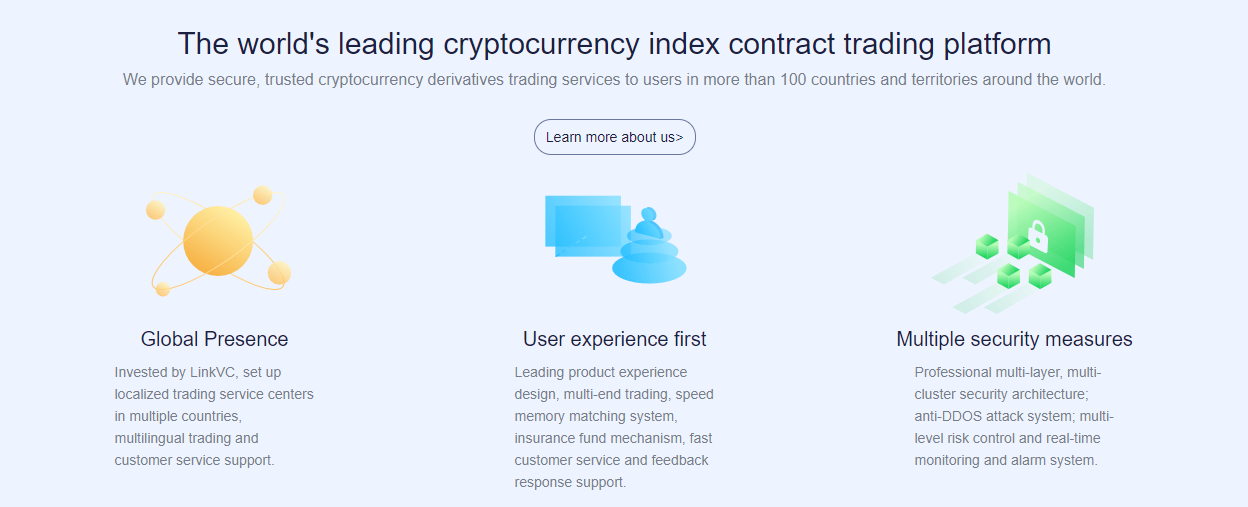

BBX’s trading platform is not only available on desktop, but also through mobile usage. This means that as long as you have mobile data reception, you can execute your trades. You can download the application to both iOS and Android-phones in Appstore or GooglePlay.

Leveraged Trading

As the exchange markets itself as a “cryptocurrency index contract trading platform”, there is no doubt that the platform focuses on leveraged trading. Leveraged trading means that you can receive a higher exposure towards a certain cryptocurrency’s price increase or decrease, without having the assets necessary. You do this by “leveraging” your trade, which in simple terms essentially means that you borrow from BBX to bet more.

For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., increasing in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD. As you bet 100 USD with 100x leverage, you have instead earned an additional 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC decreases in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

US-investors

If you’re a US-investor that wants to trade here, you’re unlucky. BBX does not accept US-investors on its platform. Don’t be too sad though, if you’re a US-investor, you can always use our Exchange Finder to find out which trading platforms that you are allowed to trade at.

BBX Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at BBX:

BBX Fees

BBX Trading Fees

The trading fees at BBX are 0.10% per trade. This means that the exchange does not distinguish between takers and makers. 0.10% per order is a competitive trading fee, substantially below the classical global industry average trading fees (arguably 0.25%). However, a majority of the exchanges that launched the last year or so actually only charges 0.10% or 0.15%. You could now argue that the new global industry average is actually somewhere around 0.10%-0.15%. This would make BBX’s fees in line with, and not substantially below, industry average.

In any event, you can be sure that the fees here are not above industry average.

For contract trading, takers pay 0.10% and makers 0.03%.

Before leaving the trading fee segment, we wanted to note that we found the following information in the platform's terms and conditions:

"BBX has a once-off lifetime membership fee. Each account also pays a monthly fee and BBX charges 6% transaction fees on all trading opportunities transacted via the platform."

We believe that 6.00% in transaction fees must be a typo, but we will follow up with the exchange and try to get clarity in this.

BBX Withdrawal Fees

When considering the fees charged by an exchange, many investors just look at the trading fees. This can potentially cater for a nasty surprise when you want to withdraw your funds after a successful trading period. Then, hefty withdrawal fees might make you wish that you had also considered them (the withdrawal fees), when choosing your exchange.

The global industry average BTC-withdrawal fees are 0.000812 BTC. This figure was calculated by us here at Cryptowisser when we compiled the withdrawal fees of 200+ exchanges. BBX charges 0.0005 BTC when you withdraw BTC. Their withdrawal fees are thus almost 40% below the global industry average.

Deposit Methods

This trading platform does not accept any other deposit method than cryptocurrencies. What does this mean? Well, it means that new crypto investors actually can’t trade here. If you don’t have any crypto but want to start trading at this trading platform, you will first have to purchase cryptocurrencies from another exchange and then, as a second step, deposit them here. Don’t worry though, we will help you find an exchange where you can purchase your first cryptos by the help of our Exchange Finder. Do the test there now and you will see what alternatives you have.

BBX Security

Someone particularly interested in security can note that BBX states on its website that it employs the following features for security purposes:

- professional multi-layer security architecture;

- multi-cluster security architecture;

- anti-DDOS attack systems;

- multi-level risk controls; and

- real-time monitoring and alarm system.