Risks You Will Encounter in Bitcoin Autotrading

Background

A relative new financial market class is here with us: cryptocurrencies. 15 years ago, forex became mainstream among the retail trading segment of the market. Then came binary options. Now, we have cryptos as the hottest asset class we have seen in the last few years. A nagging question which has followed the emergence of new assets has also cropped up once more: is it really possible to engage in Bitcoin Autotrading, i.e. trade cryptos with robots?

Well apparently, the answer is yes, as several Bitcoin autotrading bots have appeared on the market.

But why has this bitcoin autotrading robot received such negative attention? Perhaps this is because it is the first time a regulator has come out openly to denounce the product. We have had many awful forex robots come along in the past. These forex robots suck in investors who are later outraged over bad performances. We then saw legions of binary options robots which inundated the search engines with their keyword-laden sales pages, and leaving some real horror stories in their wake.

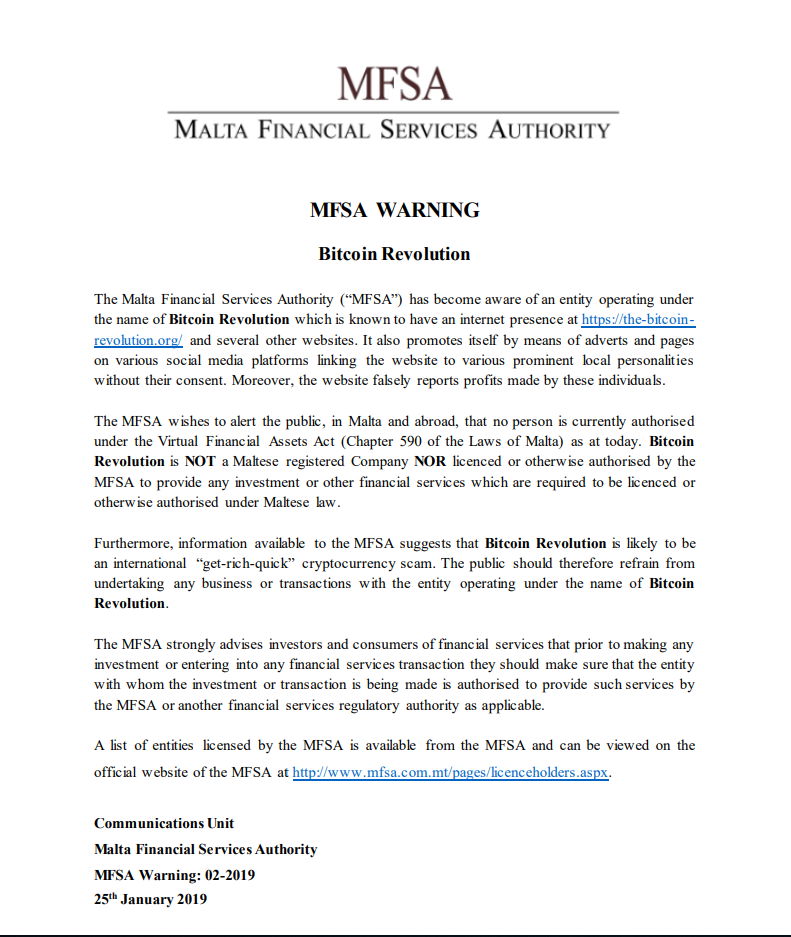

But, the hardest ever attack against a forex robot is probably the one expressed by the Maltese Financial Services Authority (MFSA) against Bitcoin Revolution. Here is the full warning from the MFSA:

The denunciation came after a familiar pattern noticed among binary options sales pages was noticed with this bot. This brought back memories of how investors lost their funds to junk robots in forex and binary options.

Using Bitcoin Autotrading Robots

Using autotrading robots is not inherently bad, but they come with hidden risks. The population of the market traders that make up the retail segment is quite large and is swelling by the day. Many of these people are uninformed and untrained investors. They do not have sound knowledge of how the markets work. The drive for many of them is simply the desire to partake in the initial bull runs that occur when a new market starts to get mainstream attention. Robot vendors know this, and they simply feed off this investing frenzy, such as that which occurred in late 2017.

Furthermore, the market for autotrading software is unregulated. This has unwittingly opened the door for every Tom, Dick and Harry to jump in with a product that promises the buyer mansion-building, yacht-buying, women-attracting and jet-riding order of profits. Who wouldn’t want to simply sail all over the world in a yacht, surrounded by pretty ladies while some wonder software literally spins data into crypto gold on a computer day in, day out?

Humans are emotional beings, and that is what robot vendors have tapped into. They use these glittering images to feed fantasies into the minds of everyday people. These everyday people can then not see any other way to achieve these financial goals. That is why many ignore the risks and come back with bad stories to tell.

Risks in Bitcoin Autotrading

So let’s look at a few of the risks involved in autotrading:

- Financial market trading is risky, but the risk levels in cryptocurrency trading far exceed what you get in forex or stocks. The market is so fast-paced that cryptos have been known to gain up to 500% in a single day of trading. If your robot traded the wrong way, such a loss could be really disastrous.

- Many autotrading software have no allowance for risk management. Any trades must not take up more than 3% of the account capital in total market exposure. The programmers of this software have often not programmed them to factor in this trade dynamic. Some even trade with no stop loss.

The only way to really last long in trading is to control risk as much as possible. And, take time to filter out only the soundest trades.

You should use an autotrading robot that makes this a priority instead of showing girls and fancy cars, parked close to a private aircraft. If you see this setup on a sales page, you are better off just closing the page.

***

DISCLAIMER

The views, the opinions and the positions expressed in this article are those of the author alone and do not necessarily represent those of https://www.cryptowisser.com/ or any company or individual affiliated with https://www.cryptowisser.com/. We do not guarantee the accuracy, completeness or validity of any statements made within this article. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author. Any liability with regards to infringement of intellectual property rights also remains with them.

Comments

Anele Fihlani

4 years agoIm interested

Joab Alele

4 years agoThis is a good article, but could I get more on the best way to trade on bitcoin?