Germany vs Liberia

Crypto regulation comparison

Germany

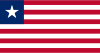

Liberia

Germany has one of the most well-defined crypto regulatory environments in Europe. BaFin has regulated crypto custody as a financial service since 2020. Notably, crypto held for over one year by individuals is completely tax-free, making Germany one of the most favorable jurisdictions for long-term holders.

The CBL has not issued crypto licenses and considers unauthorized crypto products illegal. No specific crypto legislation exists but the Financial Institutions Act requires licensing for all financial services.

Key Points

- Crypto held for more than 1 year is completely tax-free for individuals

- Short-term gains (under 1 year) taxed as income at up to 45% plus solidarity surcharge

- Annual exemption of €1,000 for short-term crypto gains (since 2024, previously €600)

- BaFin licenses crypto custody businesses under the KWG (German Banking Act) since January 2020

- MiCA framework applicable from December 2024, complementing existing German regulation

Key Points

- CBL has not approved any crypto licensing

- Unauthorized crypto products deemed illegal under Financial Institutions Act

- CBL shut down local crypto startup TACC in 2021

- No specific crypto tax framework

- Very low crypto adoption due to limited internet access