Bahamas vs Namibia

Crypto regulation comparison

Bahamas

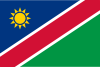

Namibia

The Bahamas enacted the Digital Assets and Registered Exchanges (DARE) Act in 2020, creating a comprehensive regulatory framework. The SCB oversees digital asset businesses. The Bahamas also launched the Sand Dollar CBDC.

Namibia enacted the Virtual Assets Act (Act 10 of 2023) establishing a comprehensive licensing framework for VASPs. The Bank of Namibia is designated as regulator. Crypto is legal but not legal tender. No specific crypto tax framework yet.

Key Points

- DARE Act (2020) provides comprehensive regulation for digital assets and exchanges

- Securities Commission of the Bahamas licenses and supervises digital asset businesses

- No income tax, capital gains tax, or crypto-specific taxes

- Sand Dollar CBDC launched in 2020 as one of the world's first

- FTX collapse in 2022 led to enhanced scrutiny and regulatory updates

Key Points

- Virtual Assets Act (Act 10 of 2023) signed into law July 2023

- VASPs must obtain licenses from Bank of Namibia to operate

- Provisional licenses granted to first two exchanges in 2025

- Non-compliance penalties up to NAD 10 million and 10 years imprisonment

- Crypto is not legal tender but merchants may accept at their discretion