Crypto Regulation in 2026: What MiCA and U.S. Enforcement Really Mean for Users January, 2026

Crypto regulation entered its enforcement phase in 2026, shifting from theory to real-world impact for everyday users. This guide explains what MiCA and U.S. enforcement actually changed, and what remains largely the same.

Written by Nikolas Sargeant

Written by Nikolas Sargeant

Crypto regulation in 2026 is no longer something you only hear about in headlines. It shows up in the places users actually care about: which exchanges still serve your region, which coins get listed or removed, how stablecoins are treated, and why withdrawals sometimes trigger extra checks.

This guide is built for everyday users, not lawyers. The goal is simple: explain what has changed in practice across the European Union and the United States, what has not changed, and how to stay functional without panic decisions.

MiCA for Users: What Actually Changed (and What Didn’t)

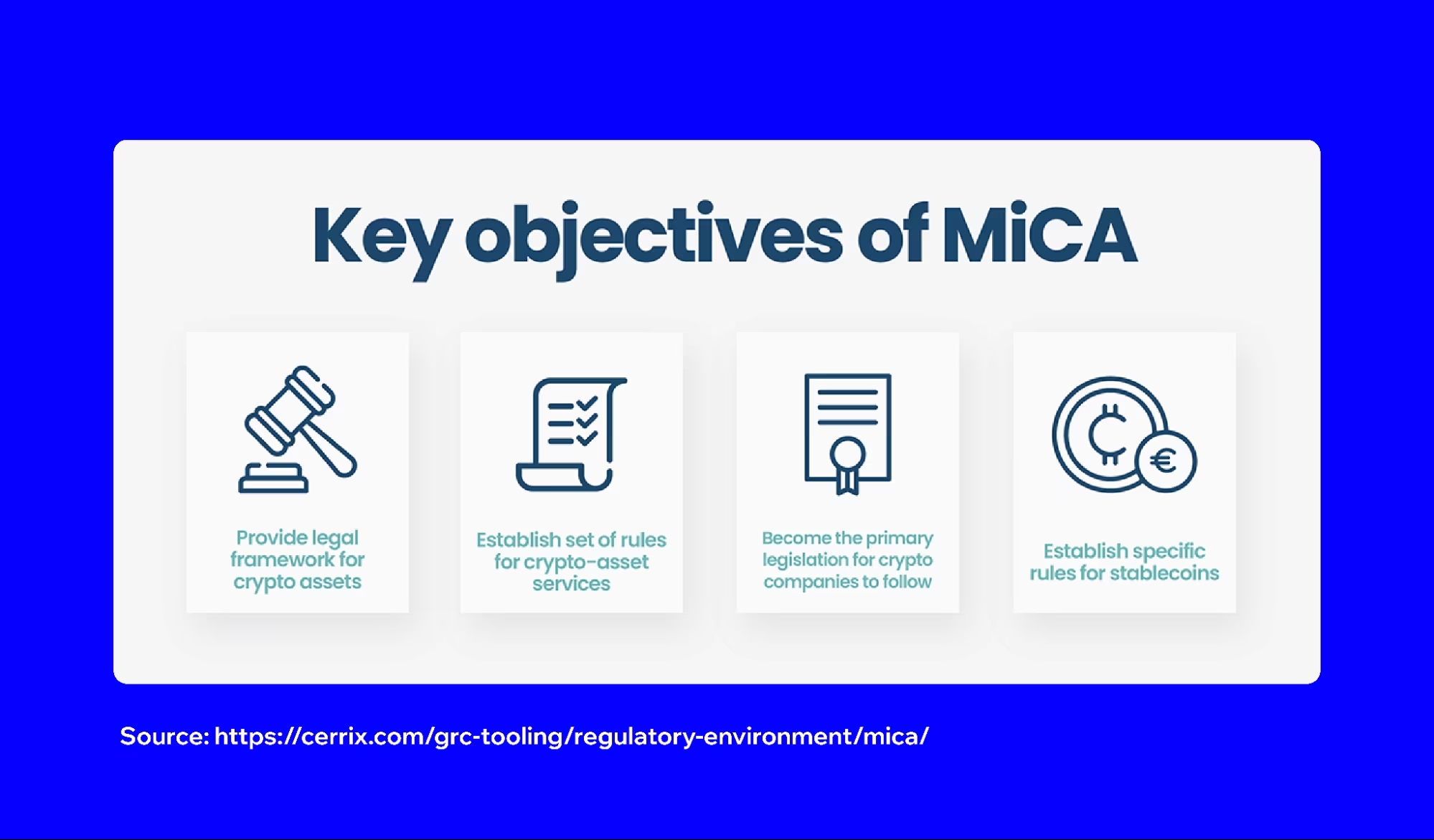

MiCA is often described as a sweeping crypto law, but for users its impact is indirect. The regulation focuses on crypto asset service providers such as exchanges, custodians, brokers, and stablecoin issuers. Users feel MiCA through changes in how these platforms operate, not through changes to the underlying technology.

What actually changed for users

- Stricter onboarding and account checks. Many EU-facing platforms now require more detailed KYC, clearer residency confirmation, and additional disclosures before accounts are fully enabled.

- More conservative listing decisions. Some tokens are listed more slowly, restricted by region, or removed entirely as platforms reassess regulatory risk under a unified EU framework.

- Stablecoin rules are tighter. Large stablecoins face issuer-level requirements around reserves, transparency, and authorization. Users may notice changes in availability, trading pairs, or usage limits on certain platforms.

- Clearer risk and product disclosures. Platforms increasingly surface warnings, eligibility checks, and product explanations before allowing access to specific features.

What did not change

- Self-custody remains legal. Holding crypto in your own wallet is not prohibited by MiCA. The regulation does not ban private wallets.

- Blockchains still function the same way. Sending, receiving, and interacting on-chain is unchanged. Compliance only applies when regulated intermediaries are involved.

- Decentralized protocols are treated differently. MiCA primarily targets identifiable service providers, not permissionless protocols, although access points can still be restricted by platforms.

How this shows up in real use

Most users experience MiCA through subtle but persistent friction rather than dramatic lockouts. Features disappear quietly. Transfers take longer. Certain assets are supported on one platform but unavailable on another.

| User action | Typical 2026 experience | Underlying reason |

|---|---|---|

| Opening an exchange account | More steps and confirmations before full access | Licensing and consumer protection requirements |

| Using stablecoins as cash equivalents | More disclosures or reduced support on some platforms | Issuer compliance and listing obligations |

| Switching between EU platforms | Different rules for the same asset or feature | Varying interpretations of compliance risk |

The key takeaway is that MiCA does not stop users from using crypto. It standardizes how companies are allowed to serve them. In practice, that means fewer gray areas, more predictable rules, and less flexibility at the platform level.

The EU Travel Rule Explained: Why Transfers Feel Slower and More Complicated

The EU Travel Rule is one of the most noticeable changes for users in 2026. While MiCA reshaped how platforms are licensed and supervised, the Travel Rule directly affects how crypto transfers are handled when a regulated provider is involved.

In simple terms, the Travel Rule requires crypto service providers to collect and share information about the sender and recipient of certain transfers. This mirrors long-standing requirements in traditional banking, but its application to crypto feels new because it interacts poorly with how crypto wallets and addresses actually work.

What the Travel Rule requires

- Sender information: Name, account details, and other identifying data tied to the sending party.

- Recipient information: Identifying details for the receiving party, even if they use a self-custody wallet.

- Data transmission: This information must be shared between service providers when both sides of a transfer are regulated entities.

These requirements apply regardless of whether the transfer happens instantly on-chain. The blockchain may confirm the transaction in seconds, but compliance checks happen off-chain and can introduce delays.

How users experience this in practice

For most users, the Travel Rule does not appear as a single “Travel Rule screen.” Instead, it shows up as extra friction around withdrawals and deposits.

- Additional fields asking you to label the recipient wallet or identify who controls it

- Withdrawal delays while transfers are screened or manually reviewed

- Higher scrutiny for larger transfers or repeated movements between platforms

- Occasional rejection of transfers to or from certain providers

| Transfer type | What users notice | Why it happens |

|---|---|---|

| Exchange to exchange | Extra confirmations or longer processing times | Both sides must exchange compliance data |

| Exchange to self-custody wallet | Questions about wallet ownership | Providers must assess recipient risk |

| Self-custody to exchange | Deposit reviews or temporary holds | Incoming funds require origin checks |

What the Travel Rule does not do

- It does not block on-chain transfers. You can still send crypto freely between wallets.

- It does not require permission from the blockchain. Enforcement happens at the service provider level.

- It does not apply equally everywhere. Implementation varies by provider and jurisdiction, leading to inconsistent user experiences.

The practical reality in 2026 is that crypto transfers are still fast at the protocol level but slower at the compliance layer. Users who understand this distinction are better prepared to avoid surprises when moving funds through regulated platforms.

U.S. Crypto Enforcement in 2026: Why Access Feels Inconsistent

Unlike the European Union, the United States still does not have a single, comprehensive crypto framework. Instead, regulation happens through enforcement actions, court decisions, settlements, and informal regulatory pressure. For users, this creates an uneven experience that can change quickly and without much warning.

In practice, U.S. crypto regulation is shaped less by what the law explicitly allows and more by what platforms believe they can safely offer. This is why two exchanges operating in the same country may provide very different products.

How regulation by enforcement affects users

- Frequent product changes. Platforms may pause staking, limit derivatives, or remove assets after enforcement actions elsewhere in the market, even if no direct ruling applies to them.

- Delistings without clear explanations. Tokens are often removed due to perceived regulatory risk rather than proven misconduct.

- Geographic restrictions. Features may be blocked for U.S. users while remaining available internationally.

- Short notice updates. Policy changes are sometimes announced with little lead time, forcing users to react quickly.

Why platforms act conservatively

In an enforcement-driven environment, uncertainty is expensive. Legal defense costs, fines, and reputational damage push companies toward caution. Many platforms choose to reduce offerings rather than test unclear boundaries.

This results in a form of self-regulation. Companies remove features preemptively, simplify product lines, and restrict access to anything that could be interpreted as a security, unregistered product, or compliance risk.

| User action | Typical U.S. experience | Reason |

|---|---|---|

| Trading smaller or newer tokens | Limited availability or sudden delisting | Unclear classification and enforcement risk |

| Using yield or staking products | Restricted or unavailable on many platforms | Past enforcement actions against similar services |

| Accessing advanced trading features | Blocked or reduced functionality | Platforms reduce exposure to regulatory scrutiny |

What has not changed for U.S. users

- Owning crypto is still legal. Holding digital assets is not prohibited.

- Self-custody remains allowed. Users can manage their own wallets without approval.

- On-chain activity continues. Protocol-level functionality is unaffected by enforcement actions.

The defining feature of U.S. crypto regulation in 2026 is unpredictability. Users who rely on centralized platforms must expect uneven access, shifting rules, and conservative product offerings driven by legal risk rather than technical limitations.

Stablecoins Under Scrutiny: What Users Can and Can’t Do in 2026

Stablecoins are one of the areas where users most clearly feel the impact of regulation in 2026. Unlike speculative tokens, stablecoins sit at the intersection of payments, banking, and crypto infrastructure, which makes them a primary focus for regulators.

The key shift is that regulation targets issuers and platforms, not individual holders. Users are still allowed to hold, send, and receive stablecoins on-chain, but how stablecoins are offered and supported by regulated services has changed.

What changed for stablecoin users

- Issuer-level compliance matters. Platforms increasingly limit support to stablecoins backed by transparent reserves and regulated issuers.

- Reduced optionality on some exchanges. Certain stablecoins may be delisted, limited to trading only, or restricted from use as collateral or payment rails.

- More disclosures and warnings. Users often see explicit statements about redemption risk, issuer responsibility, and regulatory status.

- Usage limits in specific contexts. Some platforms apply caps or additional checks when stablecoins are used for transfers or conversions.

What did not change

- On-chain transfers still work. Sending stablecoins between wallets remains permissionless.

- Self-custody is unaffected. Holding stablecoins in a private wallet does not require approval.

- Smart contract usage continues. Stablecoins can still be used in decentralized protocols, subject to access points and front-end restrictions.

Why platforms are more selective

Regulators increasingly view large stablecoins as payment instruments rather than niche crypto assets. This pushes platforms to prioritize legal clarity and issuer accountability over offering every available option.

| User activity | Typical 2026 experience | Underlying reason |

|---|---|---|

| Using stablecoins as a cash balance | More transparency prompts and occasional limits | Consumer protection and reserve requirements |

| Switching between stablecoins | Fewer supported options on some platforms | Issuer compliance and regulatory risk |

| Moving large stablecoin amounts | Additional checks or delays | AML and payment oversight obligations |

The result for users is not a ban on stablecoins, but a more controlled environment. Stablecoins remain central to crypto usage in 2026, but they are no longer treated as neutral infrastructure by regulators or platforms.

Self-Custody in a Regulated World: What Users Still Control

One of the most persistent fears around crypto regulation is that self-custody will be outlawed or made impossible. In 2026, that fear has not materialized. Users can still hold and manage their own crypto without asking permission, but the surrounding ecosystem has changed.

The key distinction regulators make is between custody and control. Regulation focuses on entities that hold assets on behalf of others. When you hold your own private keys, you are not acting as a regulated intermediary.

What self-custody still allows

- Full ownership of private keys. No third party can freeze or reverse on-chain transactions.

- Permissionless transfers. You can send and receive crypto between wallets without platform approval.

- Access to decentralized protocols. DeFi, NFTs, and on-chain applications continue to function independently of centralized oversight.

Where regulation indirectly affects self-custody

While self-custody itself remains legal, interaction with regulated platforms introduces friction. This is where most user confusion comes from.

- Wallet labeling and verification. Exchanges may ask you to declare whether a wallet is self-owned and how it is used.

- Inbound and outbound screening. Funds moving between self-custody and centralized platforms may be delayed or reviewed.

- Front-end restrictions. Some platforms restrict access to certain protocols or assets through their interfaces, even though the protocols remain live on-chain.

Common mistakes users make in 2026

- Assuming self-custody removes all compliance friction when using exchanges

- Moving large amounts without planning for screening or delays

- Relying on a single platform for on-ramps and off-ramps

| Scenario | What happens | Why |

|---|---|---|

| Holding crypto long term | No regulatory interference | Self-custody falls outside provider regulation |

| Sending funds to an exchange | Possible deposit review | Platforms must assess fund origin |

| Withdrawing from an exchange | Extra prompts or delays | Travel Rule and AML checks apply |

In 2026, self-custody remains the strongest form of user control. Regulation has not removed it, but it has made the boundaries between on-chain freedom and regulated access points more visible than ever.

What Actually Changed for Everyday Users (and What Didn’t)

By 2026, the gap between perception and reality around crypto regulation is wide. Many users believe the rules have fundamentally altered what they are allowed to do. In practice, most changes affect how users interact with platforms, not what they can do on-chain.

What changed in day-to-day usage

- Access depends more on location. Features, assets, and services increasingly vary by country and even by platform licensing structure.

- Platform choice matters more. Two regulated services may offer very different experiences based on their compliance strategy.

- More friction at entry and exit points. On-ramps, off-ramps, and transfers involving custodians are more controlled.

- Faster policy changes. Platforms update terms, listings, and features more frequently in response to regulatory signals.

What did not fundamentally change

- Holding crypto is still legal. Regulation has not criminalized ownership.

- Self-custody remains valid. Users can still manage assets independently.

- Blockchains still operate permissionlessly. Transactions settle without regulatory approval.

Why this disconnect causes confusion

Users often experience regulation as sudden loss of access rather than gradual rule changes. This is because platforms act preemptively. When enforcement risk rises, companies reduce exposure quickly, sometimes before clear guidance is issued.

The result is a sense of instability even when the legal environment is becoming more defined. Regulation feels harsher not because users lost rights, but because intermediaries are less willing to operate in gray areas.

| User expectation | 2026 reality | Reason |

|---|---|---|

| Same access across platforms | Different rules depending on provider | Varying risk tolerance and licensing |

| Stable feature availability | Frequent changes | Enforcement-driven adjustments |

| Clear regulatory boundaries | Practical ambiguity | Rules apply indirectly through platforms |

Understanding this distinction helps users adapt without overreacting. The core capabilities of crypto remain intact, but the path through regulated services is narrower and more controlled than in earlier years.

How to Navigate Crypto Regulation in 2026 Without Losing Access

Crypto regulation in 2026 does not require users to exit the ecosystem or radically change behavior. It does require more planning, better platform selection, and a clearer understanding of where regulation applies.

Choose platforms deliberately

Not all exchanges and custodial services interpret regulation the same way. Some prioritize maximum compliance and restrict features early. Others maintain broader access while staying within legal boundaries.

- Avoid relying on a single platform for all activity

- Pay attention to licensing jurisdiction and residency rules

- Expect differences in asset support and feature availability

Plan transfers, not just transactions

On-chain transfers remain fast, but regulated entry and exit points introduce friction. Users who plan movements ahead of time face fewer surprises.

- Do not assume large withdrawals will process instantly

- Label and document self-custody wallets when required

- Expect additional checks when moving funds between platforms

Separate storage from access

Many users now treat exchanges as access tools rather than storage solutions. Holding long-term assets in self-custody reduces exposure to sudden platform policy changes.

- Keep trading balances separate from long-term holdings

- Use custodial platforms primarily for conversion and liquidity

- Understand how to move assets independently if access changes

Stay alert to policy updates

Regulatory changes often surface first as updated terms of service, asset notices, or feature announcements. Ignoring these updates can lead to unexpected restrictions.

| Risk area | Best user response |

|---|---|

| Sudden delistings | Monitor announcements and keep withdrawal options ready |

| Transfer delays | Allow buffer time and avoid urgent movements |

| Feature removals | Diversify platforms and understand alternatives |

In 2026, the most resilient users are not those who ignore regulation, but those who understand where it applies and adapt without panic. Crypto remains usable, but it rewards preparation more than ever.

Key Takeaways: What Crypto Regulation Really Means in 2026

By 2026, crypto regulation has settled into a clearer pattern. The technology itself remains open and permissionless, while access through regulated services has become more structured and controlled. Most user frustration comes from confusing these two layers.

The reality users need to internalize

- Regulation targets companies, not blockchains. The biggest changes happen at exchanges, custodians, and stablecoin issuers.

- Friction is a feature, not a bug. Additional checks, delays, and disclosures are how regulation is implemented in practice.

- Access is conditional. Location, platform choice, and risk profile matter more than they did in earlier years.

What remains firmly intact

- Crypto ownership is still legal. Users can hold and transfer assets independently.

- Self-custody still works. Control over private keys remains the strongest form of autonomy.

- On-chain systems still function globally. Regulation does not rewrite protocol rules.

The practical mindset for 2026

Users who succeed in a regulated environment treat platforms as tools, not guarantees. They expect policies to change, features to disappear, and compliance requirements to evolve.

Instead of reacting emotionally to restrictions, informed users focus on optionality. They understand how to move funds, where to store assets, and how to adapt when access narrows.

| Old assumption | 2026 reality |

|---|---|

| Access is permanent | Access depends on platform risk decisions |

| Rules are clear and fixed | Rules evolve through enforcement and compliance |

| One platform is enough | Redundancy and self-custody matter |

Crypto in 2026 is more regulated, but it is not closed. Users who understand where regulation applies can continue to use crypto effectively without losing control or flexibility.

Comments

Log in to post a comment

No comments yet

Be the first to share your thoughts!