WhiteBIT

Börsen-Gebühren

Einzahlungsmethoden

Unterstützte Krypto-Währungen (65)

What is WhiteBIT?

WhiteBIT is the largest European cryptocurrency exchange by traffic, authorized by European regulatory bodies, and is part of WhiteBIT Group, which serves over 35 million users globally. The exchange has over 8 million users across Europe, Asia, and the CIS countries.

As of April 2025, WhiteBIT has a daily spot trading volume of USD 572,860,623, placing the exchange at position 49 in the CoinMarketCap rankings. Additionally, WhiteBIT’s annual trading volume has reached USD 2.7 trillion.

WhiteBIT Advantages

WhiteBIT markets itself as a licensed crypto exchange with features for both new and professional traders. Also, they highlight the competence of their Support team.

But that’s not all of the promoted advantages of this platform. The platform also emphasizes a few other features that they find helpful for its users. A few of these is that the user interface is customizable, orders are executed instantly through the help of a trading engine performing 10,000 trades per second.

In addition, fees are competitive (more on that below), and the platform offers a strong API.

WhiteBIT Referral Program

Another advantage that we feel deserves to be mentioned separately is the WhiteBIT Referral Program. Through this program, you can get up to 50% of all trading fees generated by your referrals.

Simply create an account here, share your personalized affiliate link with your friends, and you can just sit back and enjoy your passive earnings. It's as easy as that!

Tools

Aside from Limit and Market Orders, WhiteBIT has Stop-Limit and Stop-Market Orders on Spot trading - but - it does not have Conditional orders. OCO (One Cancelled Other) orders are available on Margin trading, which also includes Limit and Market.

Stop-Limit and Stop-Market Orders allow users to prevent losses when the market is too volatile.

OCO means that as soon as one of the orders is partially or completely executed, the second order is automatically canceled.

WhiteBIT also has Demo Token, a free tool that helps users to learn the basics of crypto trading and test their strategies on the DBTC/DUSDT pair.

Futures trading let users trade futures on Bitcoin, Ethereum, XRP, LTC and others on the WhiteBIT exchange.

Mobile Support

The WhiteBIT platform is not only available for desktops, but also for Android and Apple mobile phones. Most traders in the crypto world today carry out their trades via desktop (around 70% or so). However, there are naturally people out there that want to do it from their smartphones as well. If you’re one of those people, then WhiteBIT can still be for you, seeing as it has a native mobile application.

API

WhiteBIT provides both public and private REST APIs. Public REST APIs provide such market data as the current order book, recent trading activity, and trade history. Private REST APIs allow you to manage both orders and funds.

WhiteBIT Trading View

Different exchanges have different trading views. You should determine which one suits you the best. What they usually have in common is that they all show the order book or at least part of it, a price chart of the chosen crypto, and order history. They normally also have buy and sell boxes. This is the spot trading interface on WhiteBIT:

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

WhiteBIT Fees

WhiteBIT Trading fees

This exchange doesn’t charge different fees between takers and makers. Their fee model is something that we call a “flat fee model”, meaning that it does matter if you are a taker in the trade (meaning a person who is grabbing a new order instantly) or a maker in the trade (meaning a person who is providing an order that doesn't have an existing taker in the order book).

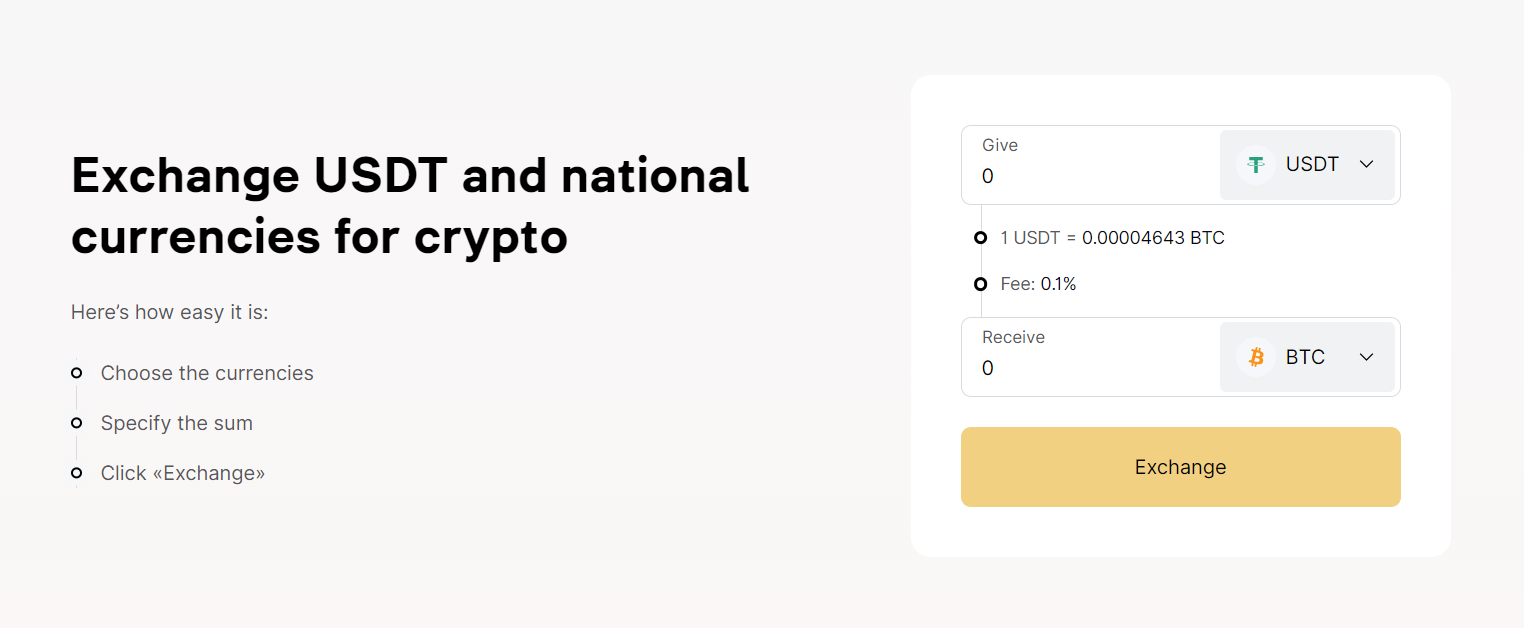

Here, both takers and makers pay 0.10%. 0.10% is a fairly competitve spot trading fee. Industry averages for takers are 0.2294%, and for makers 0.1854%, according to this extensive report on the subject. Daily fee for using funds in margin trading and borrow is 0.0585%, which also is competitive.

Some trading pairs also have even lower fees. The exact amount is displayed on the Live Trading page when an order is placed.

Withdrawal Limits

Withdrawal fees depend on blockchain fees and the price of an asset. They can be changed without notice. Always check the information on the withdrawal page.

Deposit Methods and Restricted Jurisdictions

Deposit Methods

The exchange supports 820+ trading pairs with crypto and fiat, including BTC/USD, BTC/USDT, and BTC/EUR. Deposits and withdrawals are possible with Visa and MasterCard, as well as Advcash, Geo-Pay, and monobank. The fiat currencies available for trading are USD, UAH, EUR, KZT, TRY, GEL, GBP, PLN, CZK, BGN, and AUD.

The fact that fiat currency deposits are permitted at all also makes this exchange an “entry-level exchange”, meaning an exchange where new crypto investors can take their first steps into the exciting crypto world.

Restricted Jurisdictions

At the moment, WhiteBIT does not allow US investors to trade on the exchange. Neither are investors from any of the following countries allowed:

Afghanistan, American Samoa, U.S. Virgin Islands, Territory of Guam, Iran, Yemen, Libya, State of Palestine, Puerto Rico, Somalia, the Democratic People’s Republic of Korea, The Northern Mariana Islands, Syria, Russian Federation, Republic of Belarus, Republic of Sudan, Transnistria, temporarily occupied territories of Georgia, Turkish Republic of Northern Cyprus, Western Sahara, Federal Republic of Ambazonia, Kosovo, South Sudan, and temporarily occupied territories of Ukraine.

However, if you are not from any of the countries listed above, try it out!

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!