Stellar DEX

Exchange Fees

Deposit Methods

Cryptos (15)

UPDATE 31 March 2020: This exchange is today more commonly known as Stellar Term. Accordingly, we have marked Stellar DEX as "dead" and moved it to our Exchange Graveyard. Please refer to our review of Stellar Term instead.

Stellar DEX Review

Stellar DEX (or Stellar Decentralized Exchange) is a so called “decentralized exchange”. There are many decentralized exchanges out there and there are people confidently claiming that the increasing number of decentralized exchanges is a threat to the regular centralized exchanges.

Decentralized exchanges do not require a third party to store your funds, instead, you are always directly in control of your coins and you conduct transactions directly with whoever wants to buy or sell your coins. Decentralized exchanges normally do not require you to give out personal information either. This makes it possible to create an account and right away be able to start trading. The servers of decentralized exchanges spread out across the globe leading to a lower risk of server downtime.

The exchange apparently stores the order book “on-ledger”, has transaction settlement on-ledger and has order matchmaking built into its protocol.

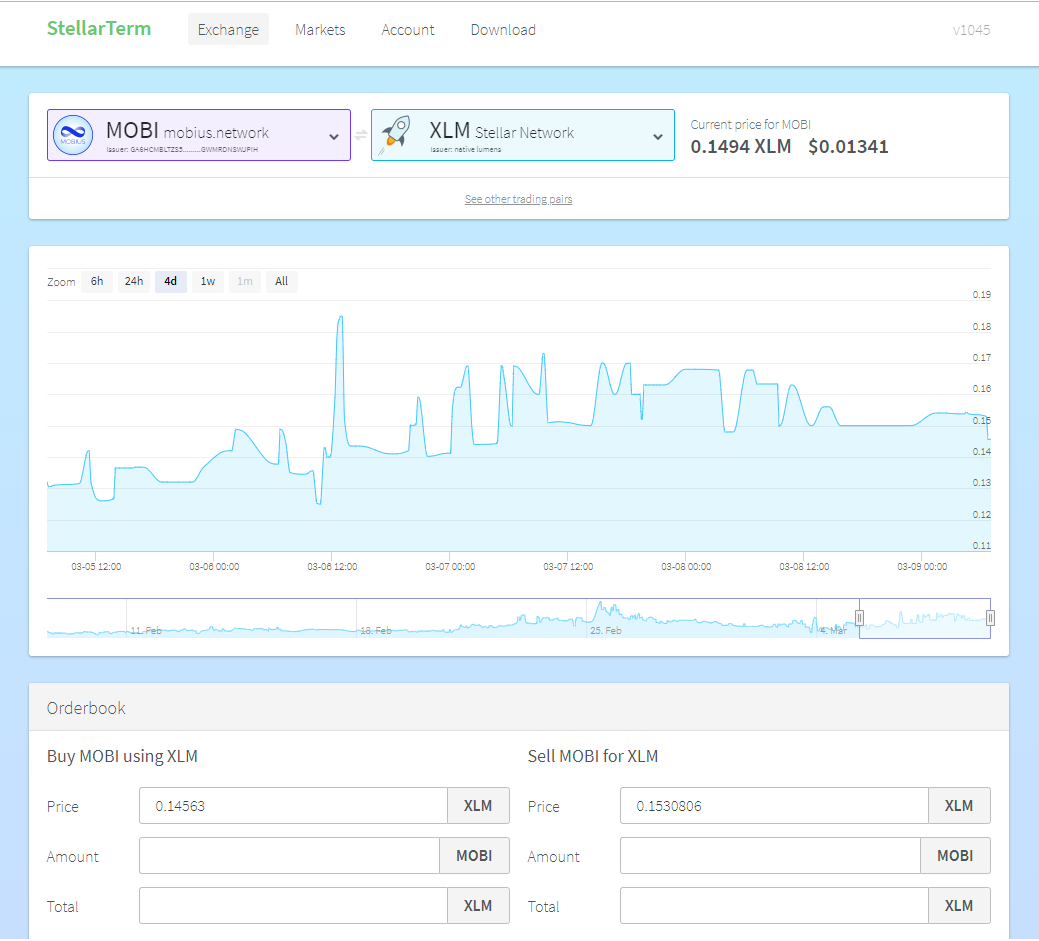

Stellar DEX Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at Stellar DEX:

Stellar DEX Fees

Stellar DEX Trading fees

We have not been able to ascertain exactly what Stellar DEX’s trading fees amount to. This is partly due to the decentralized nature of this exchange. Trading fees are generally easier to find (or calculate) when it comes to centralized exchanges.

The absence of clearly stated trading fees is potentially a risk for you as an investor. Accordingly, we strongly urge you to make your own analysis of the trading fees at Stellar DEX before depositing any funds here and before concluding that it is the best cryptocurrency exchange site for you.

Stellar DEX Withdrawal fees

Stellar DEX does not charge any withdrawal fees at all. This is a very strong competitive edge in the market and really distinguishes Stellar DEX from most other top crypto exchanges.

Deposit Methods

Stellar DEX does not accept deposits of fiat currencies. Accordingly, new crypto investors without prior holdings of cryptocurrencies cannot trade at Stellar DEX. If you don’t have any crypto but want to start trading here, you will first have to purchase cryptocurrencies from another exchange and then, as a second step, deposit them here. Use our Exchange Finder to find a cryptocurrency exchange where you can purchase your first cryptos.

Stellar DEX Security

The servers of decentralized exchanges normally spread out across the globe. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime. It also means that decentralized exchanges are virtually immune to attacks. This is because if you take out one of the servers, it makes little to no difference for the network of servers in its entirety. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a decentralized exchange, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange until you withdraw them to your private wallet. A hacker can therefore hack a centralized exchange and steal your funds held at such exchange. That is not possible at a DEX.