Skilling Crypto

Exchange Fees

Deposit Methods

Cryptos (52)

Skilling Review

Pros

- Lots of assets in addition to cryptos

Cons

- A limited number of cryptocurrencies

- High fees

- Limited trading options

About Skilling

Skilling is a Scandinavian fintech company founded in 2016. They mainly specialize in “currency pairs, shares of your favorite companies, popular commodities and indices from around the world,” but also include several dozen cryptocurrencies.

All Trades are Forex and CFD

At Skilling, all trades are either forex or Contract for Difference (CFD). Forex, a.k.a. the foreign exchange, is a global marketplace where currencies are traded for one another. The daily trading average here is roughly $5 trillion.

A CFD is a form of trading that allows investors to speculate on price changes of an asset without actually owning the underlying asset. At Skilling, all trading is necessarily one of these two types.

Leveraged trading is available within these categories as well. In leveraged trading, you can use debt to “leverage” a larger deal. This comes with more risk and potential profit.

Deposit Methods

Skilling offers the basic deposit methods, though not too many. Their site lists six deposit methods and notes that some of them will be restricted by country.

The six deposit methods listed are:

- Bank cards

- Trustly

- Skrill

- Neteller

- Klarna

- Swish

Both Skrill and Neteller come with a deposit fee at Skilling. The other deposit methods are fee-free.

Fees

They do charge fees to trade between fiat currencies at Skilling. However, they do charge a maker and taker fee on crypto trades. This is 0.1% each. This is well above average, as the most extensive report makes clear. According to this evidence, the industry average for a takers fee is 0.0594% and for makers 0.0242%.

Tokens Available

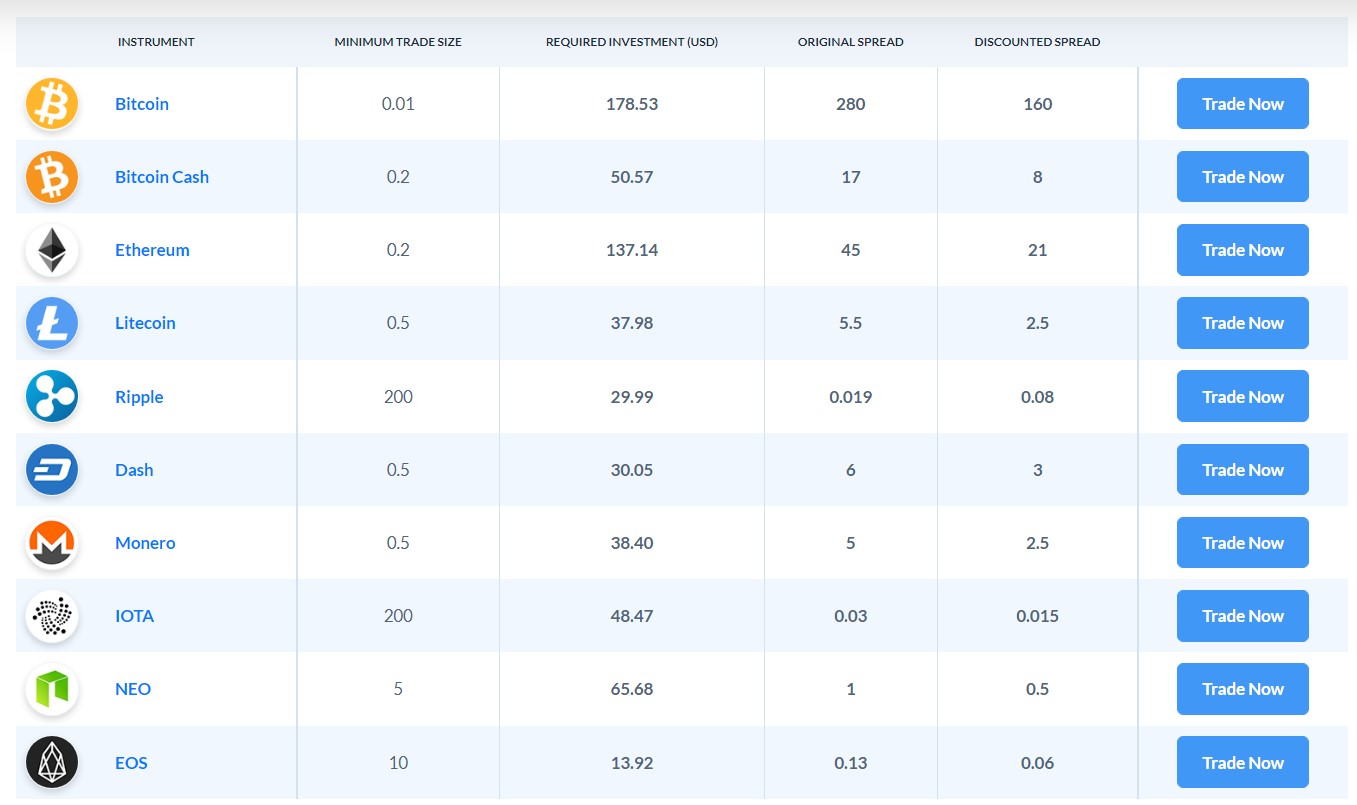

Skilling advertises that it supports more than 55 cryptocurrencies. This amount is on the lower end of the spectrum, though should be enough for casual crypto investors. After all, that is really who Skilling is for as they do not specialize in crypto per se. Here you can trade indices, commodities, shares, and more, so having some cryptos is something of a side project.

Who Can Sign Up Here?

Skilling does accept users from most parts of the globe. Though this does come with one large restriction: Skilling does not currently accept investors from the United States.

On their website, they only list the USA and Iran as excluded territories. People from most of the rest of the world should have no problems signing up and completing KYC protocols successfully.

No NFT Support

Non-fungible tokens (NFTs) are a growing part of the crypto economy. However, Skilling does not offer any NFT support. Other exchanges have NFT marketplaces, allowing you to earn passive income with your NFTs or at least to store them in a wallet.

Skilling is not generally focused on blockchain technologies as their main focus, so it is no surprise that they do not offer these services.

Mobile Support

You can access all the functions of the Skilling exchange on the website or the app. It is available for iOS and Android devices.

Who is Skilling for?

Skilling is for advanced investors outside the US. This exchange really does not specialize in crypto, so it is also for someone looking to invest in crypto as only a small portion of their portfolio. If you want to invest in crypto, there are better exchanges out there!