KuMEX

Börsen-Gebühren

Einzahlungsmethoden

Unterstützte Krypto-Währungen (1)

UPDATE 25 February 2021: KuMEX has rebranded into Kucoin Futures. Please see our review of KuCoin Futures here.

Accordingly, we have marked this exchange as "dead" and moved it into our Exchange Graveyard.

KuMEX Review

KuMEX is an exchange from Singapore that launched on 8 July 2019. It is an exchange focusing on derivatives trading in BTC, and it is backed by KuCoin. Actually, the name KuMEX is short for KuCoin Mercantile Exchange. You can also access the platform by pressing “Contracts” on KuCoin’s website:

KuMEX offers its platform in two formats: Lite and Pro. Pro is for the investors that are more experienced, whereas Lite is for the investors that are beginning their contract trading careers. KuMEX markets the Lite version of the platform as the most friendly platform for new futures users in the world.

KuMEX Lite

There are a few things with the Lite version that should be mentioned specifically, to show how it is different from the more advanced versions of contract trading platforms.

First off, the price trending chart is simplified by switching from candlestick charts to line charts.

Second, on KuMEX Lite, users just need to input the order amount, then decide on the leverage and long/short to place an order. In addition, what they input for each order is the amount of money rather than the number of slots, making it more friendly for novice traders.

Third, KuMEX Lite provides a long-short ratio to help users understand the latest market sentiments. It also provides a revenue calculator to help calculate the return with different principals, leverages and strategies. In addition, revenue ranking on KuMEX Lite can provide insights regarding other traders’ strategies and ROI, resulting in a more advanced trading strategy.

Fourth and finally, the minimum order amount is only USD 1.00 (it is often much higher).

Languages

KuMEX supports 13 languages: English, Chinese, Russian, Vietnamese, Turkish, German, Korean, Dutch, French, Spanish, Portuguese, Italian and Chinese Traditional.

US-investors

According to info we have received directly from KuMEX, US-investors may trade here. Any US-investors interested in trading here should in any event form their own opinion on any issues arising from their citizenship or residency.

Leveraged Trading

KuMEX focuses on leveraged trading on its platform. This means that you can receive a higher exposure towards a certain crypto’s price increase or decrease, without having the assets necessary. You do this by “leveraging” your trade, which in simple terms means that you borrow from the exchange to bet more. You can get as much as 100x leverage on this platform.

For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., going up in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD. As you bet 100 USD with 100x leverage, you have instead earned an extra 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC goes down in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

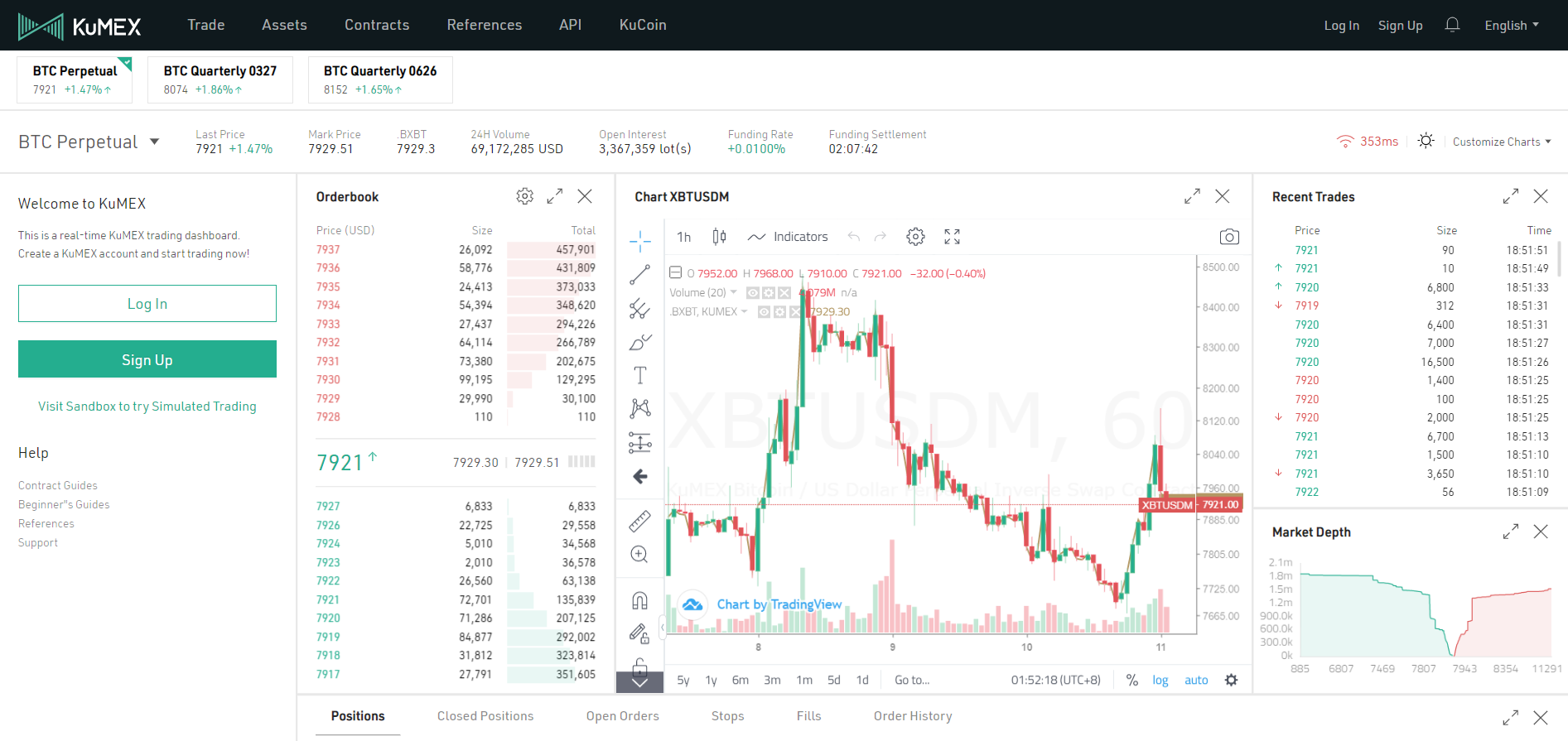

KuMEX Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen crypto and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can see that it feels right to you. This is the trading view at KuMEX (using Pro Version):

KuMEX Fees

KuMEX Trading fees

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. We call makers “makers” because their orders make the liquidity in a market.

Starting 15 January 2020, KuMEX charges takers 0.06% and makers 0.02%. These fees are quite in line with industry averages when it comes to derivatives trading. There is also a settlement fee (0.025%) that is charged as soon as a derivatives contract is settled.

KuMEX Withdrawal fees

KuMEX charges a withdrawal fee amounting to 0.0005 BTC when you withdraw BTC. This is also far below the global industry average BTC-withdrawal fee, being 0.000812 BTC. So KuMEX’s fees are roughly 40% lower than the industry average.

All in all, both the trading fees and withdrawal fees at KuMEX are in line with or even below the industry averages, which is great.

Deposit Methods

At KuMEX, you can deposit through credit cards, but not via wire transfer. It is usually the other way around. Credit card deposits can be very helpful for newer crypto investors as it creates an “easy way in” into the crypto world. That fiat currency deposits are at all accepted also makes KuMEX a so called “entry-level exchange”.